Paramount, backed by Saudi Arabia's Public Investment Fund, launches hostile takeover bid for Warner Bros. Discovery, one day after US president Donald Trump says the Netflix deal 'could be a problem'

The Paramount bid is also supported by Trump's son-in-law Jared Kushner, so that's probably not great for Netflix's ambitions.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

I said last week, after Netflix won the bidding war for Warner Bros. Discovery and its game studios, that the fight might not actually be over, and sure enough it is now on for real: Paramount Skydance, whose offer to acquire the company was rejected in favor of the Netflix bid, has launched a hostile takeover bid for WBD valued at more than $108 billion.

The deal between Netflix and Warner began to look shaky on Sunday when, as reported by AP, US president Donald Trump said it "could be a problem" because of the combined market share Netflix would be left with. Trump said the deal has to "go through a process and we’ll see what happens," presumably referring to required regulatory approvals, but added, "I'll be involved in that decision"—which is not how things are supposed to work, but here we are.

Less than 24 hours later, Paramount Skydance, headed by CEO David Ellison—son of ultra-rich guy and high-profile Trump supporter Larry Ellison—made its move. Paramount Skydance is offering $30 per share for Warner Bros. Discovery in an all-cash deal that, unlike the Netflix deal, includes the Global Networks division that was excluded in the Netflix deal.

It's the same offer that was previously rejected by Warner's board of directors, so now Paramount is "taking our offer directly to shareholders to give them the opportunity to act in their own best interests and maximize the value of their shares," David Ellison said in a statement at strongerhollywood.com.

"We believe our offer will create a stronger Hollywood," Ellison said, just in case the URL was too subtle. "It is in the best interests of the creative community, consumers and the movie theater industry. We believe they will benefit from the enhanced competition, higher content spend and theatrical release output, and a greater number of movies in theaters as a result of our proposed transaction.

"We look forward to working to expeditiously deliver this opportunity so that all stakeholders can begin to capitalize on the benefits of the combined company."

Paramount also said that it "is highly confident in achieving expeditious regulatory clearance for its proposed offer," whereas the Netflix acquisition would face "multiple protracted regulatory challenges across the world" as well as "increased execution risk," because Netflix has never done a big deal like this before.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

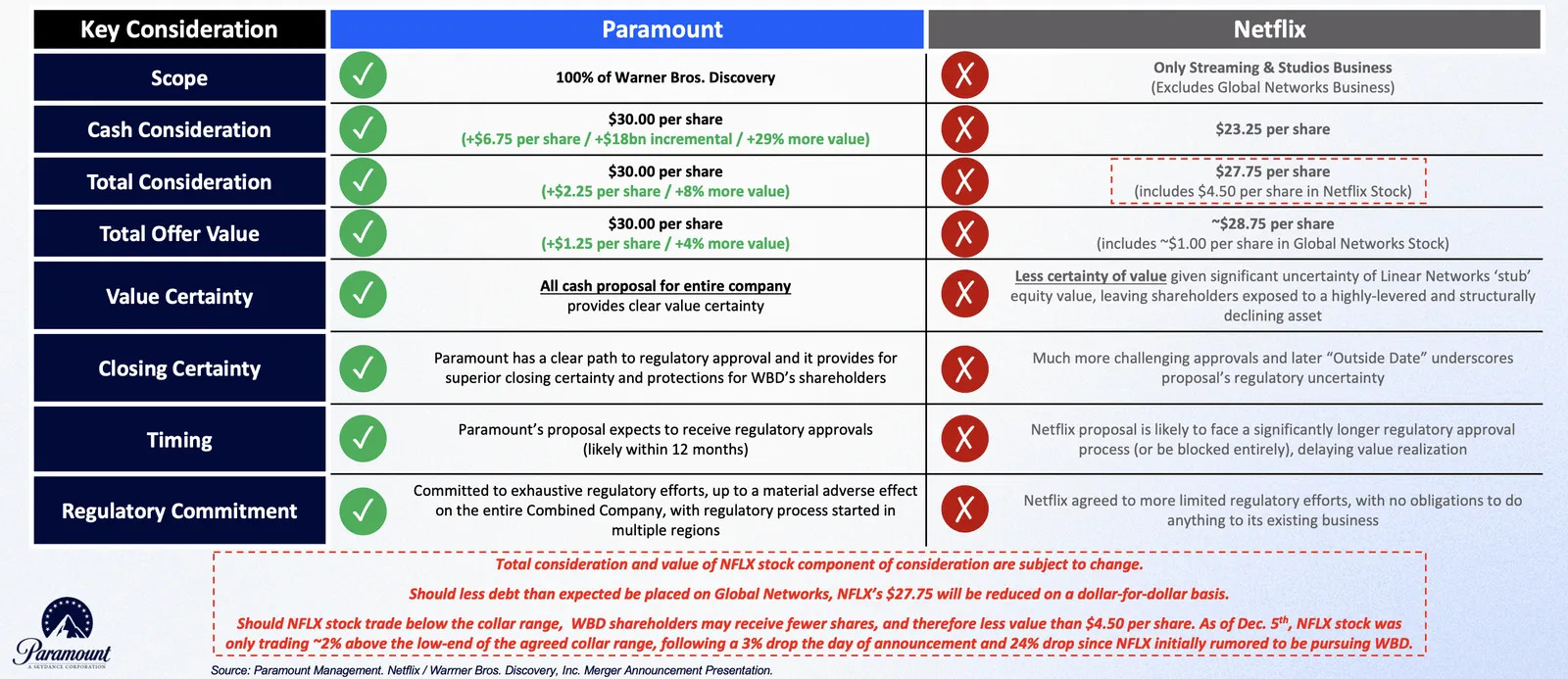

There's even a handy chart:

I'm not a betting man, generally speaking, but if I was I'd be putting my money on Paramount coming out on top of this one. Not that I have any idea which offer is "better"—at some point the whole more billions thing becomes meaningless as anything more than a gauche ego-stroke—but a December 8 SEC filing indicates that Affinity Partners, the investment firm owned by Donald Trump's son-in-law Jared Kushner, is one of the deal's backers, and that is a significant advantage.

And Kushner isn't the only big Trump guy supporting Paramount's offer: Saudi Arabia's Public Investment Fund, headed by Crown Prince Mohammed bin Salman, is in on the action as part of a combined $24 billion commitment that also includes Abu Dhabi's L'imad Holding Company PJSC and the Qatar Investment Authority—despite recent reports that the PIF is cutting back on such things.

This will be at least the second time Kushner and bin Salman have worked together on a big-money buyout: They previously teamed up for Saudi Arabia's recent $55 billion buyout of Electronic Arts. Chinese tech giant Tencent was also set to back Paramount's Warner Bros. Discovery bid, but was removed as a financing partner over concerns that its presence could leave the proposed takeover subject to review by the Committee on Foreign Investment in the United States.

Netflix, for its part, seems to be taking the development well. In an investor's Q&A session that took place after the Paramount announcement, Netflix co-CEO Ted Sarandos said amidst laughter that "today's move was entirely expected."

"We have a deal done, and we are incredibly happy with the deal," Sarandos said. "We think it's great for our shareholders, we think it's great for consumers. We think it's a great way to create and protect jobs in the entertainment industry. We're super confident we're going to get it across the line and finish. So we're excited."

2025 games: This year's upcoming releases

Best PC games: Our all-time favorites

Free PC games: Freebie fest

Best FPS games: Finest gunplay

Best RPGs: Grand adventures

Best co-op games: Better together

Andy has been gaming on PCs from the very beginning, starting as a youngster with text adventures and primitive action games on a cassette-based TRS80. From there he graduated to the glory days of Sierra Online adventures and Microprose sims, ran a local BBS, learned how to build PCs, and developed a longstanding love of RPGs, immersive sims, and shooters. He began writing videogame news in 2007 for The Escapist and somehow managed to avoid getting fired until 2014, when he joined the storied ranks of PC Gamer. He covers all aspects of the industry, from new game announcements and patch notes to legal disputes, Twitch beefs, esports, and Henry Cavill. Lots of Henry Cavill.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.