Is it just us or does mining 10 bitcoin a day not sound like much for a cryptocurrency megacorp?

Yeah, that still works out as just shy of $300K worth of bitcoin each day but, considering recent crypto crashes, can this really be sustainable?

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Every Friday

GamesRadar+

Your weekly update on everything you could ever want to know about the games you already love, games we know you're going to love in the near future, and tales from the communities that surround them.

Every Thursday

GTA 6 O'clock

Our special GTA 6 newsletter, with breaking news, insider info, and rumor analysis from the award-winning GTA 6 O'clock experts.

Every Friday

Knowledge

From the creators of Edge: A weekly videogame industry newsletter with analysis from expert writers, guidance from professionals, and insight into what's on the horizon.

Every Thursday

The Setup

Hardware nerds unite, sign up to our free tech newsletter for a weekly digest of the hottest new tech, the latest gadgets on the test bench, and much more.

Every Wednesday

Switch 2 Spotlight

Sign up to our new Switch 2 newsletter, where we bring you the latest talking points on Nintendo's new console each week, bring you up to date on the news, and recommend what games to play.

Every Saturday

The Watchlist

Subscribe for a weekly digest of the movie and TV news that matters, direct to your inbox. From first-look trailers, interviews, reviews and explainers, we've got you covered.

Once a month

SFX

Get sneak previews, exclusive competitions and details of special events each month!

Update: We previously suggested that the company may be experiencing 'theoretical' losses. After which, Hut 8 got in contact with us explaining "Our financial results demonstrate that Hut 8 is not experiencing “theoretical losses” either “massive” or otherwise, as we continue to be profitable."

Good for them.

Original story: We've been taking a look at exactly how much bitcoin a major mining firm actually bags. What with the recent red candlestick market crash drama, it's clear bitcoin isn't as profitable today as it once was. But has it really made a difference to huge mining operations?

Turns out, even with stacks upon stacks of ASICs and GPUs, all linked up and pumping away with the use of abundant hydro and nuclear power, huge mining initiatives, such as the Hut 8 Mining Corp, seem to be taking losses. And yet are still growing.

Hut 8 is "one of North America's largest, innovation-focused digital asset mining pioneers." It recently proclaimed that it's holding (HODLing?) 7,078 self-mined bitcoin in reserve—that's around $210 million worth of cryptocurrency in today's market.

While that might sound like a win for Hut 8, let's wind the clocks back to see just how much of a flop this year has been for the company. Since Hut 8 notes an average production rate of around 10 bitcoin per day, that would mean it had roughly 5,578 bitcoins at the start of 2022. Back in January, one bitcoin was worth $47,733, but since then, a single bitcoin has dropped to a worth of just $29,509.

Seeing as the company also spent $30m on Nvidia CMP GPUs, and even if you don't take into account the power costs associated with running a firm like this, all that points to massive theoretical losses because of the potent fluctuation in the cryptocurrency market.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

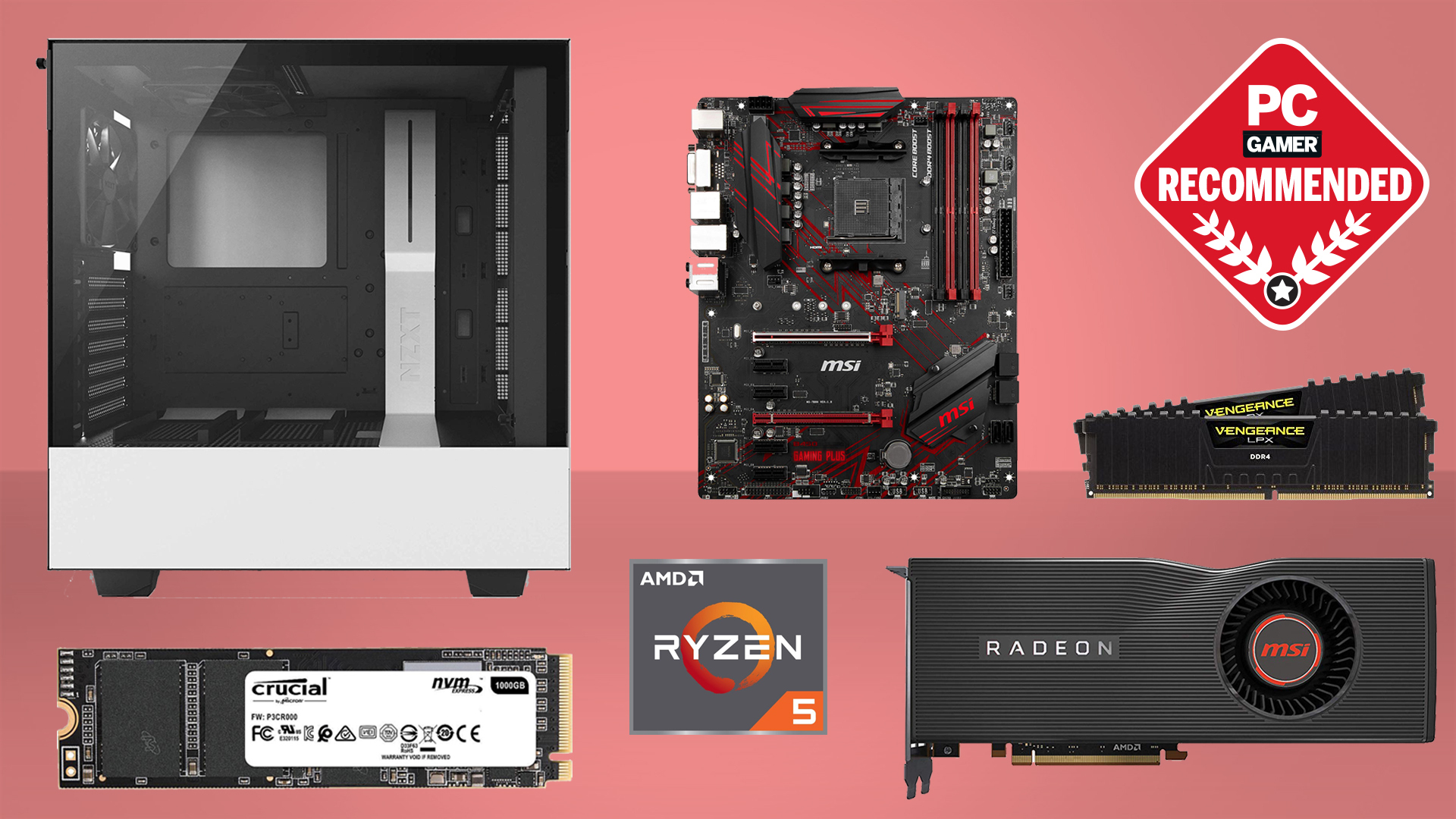

Best CPU for gaming: The top chips from Intel and AMD

Best gaming motherboard: The right boards

Best graphics card: Your perfect pixel-pusher awaits

Best SSD for gaming: Get into the game ahead of the rest

Sparing you the (totally in-depth and mega smart) calculations, despite the company's 1,500 increase in bitcoin held, that actually works out as a comparative loss of around $57 million. And yet, the company continues to expand.

Hut 8 just revealed that testing has concluded at North Bay, Ontario, and there it'll be expanding its operations. Currently there are sites located in Drumheller, and Medicine Hat, Alberta, which run off "an abundance of renewable energy."

Hut 8 says it has also managed to save money by limiting power consumption at Drumheller "when the spot price of power spiked." Exactly how much the spike in energy prices and the crypto crash has affected it remain to be seen.

It is still both actually and figuratively making money, after all.

Having been obsessed with game mechanics, computers and graphics for three decades, Katie took Game Art and Design up to Masters level at uni and has been writing about digital games, tabletop games and gaming technology for over five years since. She can be found facilitating board game design workshops and optimising everything in her path.