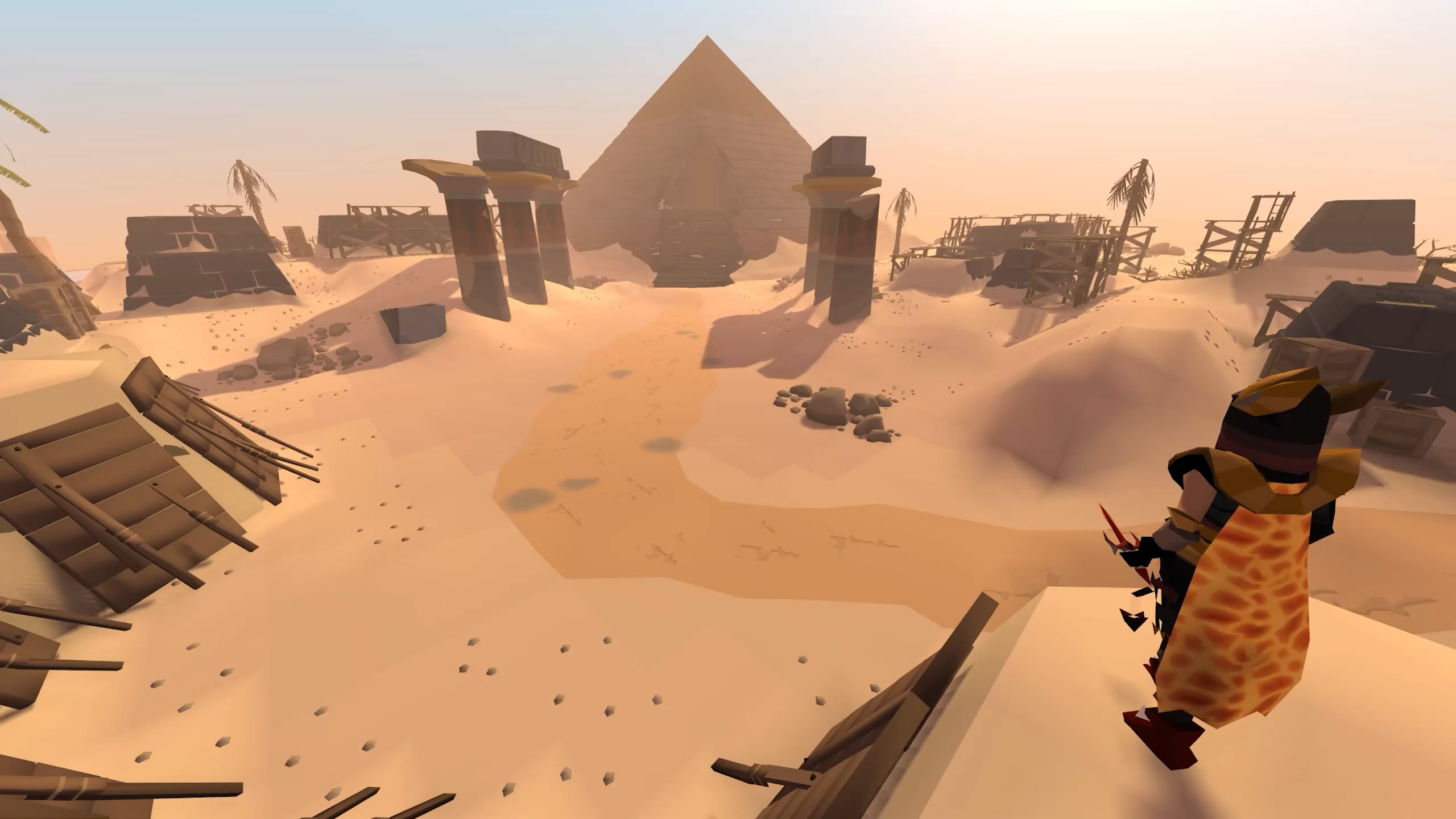

EU tax officials confront the most pressing legal question of our time: If you sell RuneScape gold to someone and they use it to buy a magic sword, do you still have to pay taxes?

"Gold all doth lure, Gold doth secure all things. Alas, we poor!"

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Every Friday

GamesRadar+

Your weekly update on everything you could ever want to know about the games you already love, games we know you're going to love in the near future, and tales from the communities that surround them.

Every Thursday

GTA 6 O'clock

Our special GTA 6 newsletter, with breaking news, insider info, and rumor analysis from the award-winning GTA 6 O'clock experts.

Every Friday

Knowledge

From the creators of Edge: A weekly videogame industry newsletter with analysis from expert writers, guidance from professionals, and insight into what's on the horizon.

Every Thursday

The Setup

Hardware nerds unite, sign up to our free tech newsletter for a weekly digest of the hottest new tech, the latest gadgets on the test bench, and much more.

Every Wednesday

Switch 2 Spotlight

Sign up to our new Switch 2 newsletter, where we bring you the latest talking points on Nintendo's new console each week, bring you up to date on the news, and recommend what games to play.

Every Saturday

The Watchlist

Subscribe for a weekly digest of the movie and TV news that matters, direct to your inbox. From first-look trailers, interviews, reviews and explainers, we've got you covered.

Once a month

SFX

Get sneak previews, exclusive competitions and details of special events each month!

On September 11, advocate general at the Court of Justice of the European Union Juliane Kokott issued an opinion requesting a preliminary ruling from the Tax Disputes Commission under the Government of the Republic of Lithuania on a case concerning that most fundamental financial quandary with which all states, federations, and empires in their might and majesty must—in time—contend: Should you have to pay taxes if you sell RuneScape gold to somebody for real money?

The opinion's introduction, which begins with a quote from Goethe's Faust—"Gold all doth lure, Gold doth secure all things. Alas, we poor!"—explains that "a taxable person" avoided paying VAT [value added tax] on "not insignificant" transactions in which RuneScape gold was purchased from players and sold to others at a profit (via GamesRadar).

"In the present case, the Court has an opportunity to deal with the way in which an entirely new form of gold trading is considered for VAT purposes," Kokott says.

This taxable individual, Kokott explains, was found to have bought and resold through "various forums, groups, and platforms such as Facebook, Discord, and Skype" enough RuneScape gold to earn €415,484—approximately $488,000 USD—between 2021 and 2023.

In Lithuania, small businesses that earn under €45,000 per year are exempt from VAT obligations. Having handily cleared that threshold, our industrious gold sellers were expected to pay the appropriate taxes. They did not—hence the January 2024 legal proceedings in which the applicant was ordered to pay €46,688 in retroactive VAT.

In her opinion, Kokott writes that, as people tend to do when they're suddenly on the hook for the equivalent of $55,000, "the applicant disagreed with the decision of the tax authority and lodged a complaint."

To laymen like you and I, this situation probably seems pretty open and shut. If you make money on something, you pay taxes on it. That's the way the world works, unless you're wealthy enough that you'd topple entire nations' GDP if you were ever held accountable for your sins. I'd hate to be in that world!

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

However, the taxable person in question, Kokott writes, insists that "the income from the sale of in-game gold is income from trading in virtual currencies and is therefore exempt from VAT," much like how exchanging Bitcoin or other cryptocurrencies is exempt from VAT in some EU countries.

"According to the applicant, if it is not a virtual currency, then in-game gold should be regarded as a multi-purpose voucher, which is not subject to VAT," Kokott says.

It's an interesting gambit—but does it have any merit? After reading Kokott's thoughts, I'm going to go with "yeah, no."

In her request for a preliminary ruling from Lithuania's Tax Disputes Commission that would nip this thing in the bud, Kokott points to two portions of relevant EU law that handle VAT exemptions.

"Article 135(1)(e) of the VAT Directive exempts transactions, including negotiation, concerning currency, bank notes and coins used as legal tender," Kokott writes. "If the applicant’s transactions involving in-game gold are to be covered by the exemption, in-game gold would have to be legal tender."

Considering I can't deposit my RuneScape gold into my bank account, Kokott says in-game currency "can be clearly ruled out" as legal tender.

Which brings us to the voucher question. Kokott writes that, for in-game gold to be considered a voucher—which is exempt from VAT under Article 30b(2) of the EU's VAT Directive—it must meet "two cumulative conditions."

"First, the goods to be supplied or the potential supplier must be apparent from the voucher or its terms and conditions," Kokott says. "Second, in-game gold would have to give rise to the obligation to accept it as consideration for a service," because "the purpose of a voucher is to ‘document’ a taxable person’s obligation to supply (in the present case) a service."

To make this simpler, imagine you receive a voucher you can redeem for a product or service. That voucher would specify the conditions under which it can be redeemed, and what it can be redeemed for—which in-game gold doesn't do, because it can be used for whatever the player wants to spend it on. And that voucher would represent an obligation for the voucher's supplier to provide a later service—which isn't the case with in-game gold, either.

"In-game gold itself is therefore already the consumable benefit and does not merely serve to procure a later consumable benefit in the form of an as yet unspecified service," Kokott says, before penning what is perhaps history's single greatest line written about financial law:

"The mere fact that a service (in-game gold) can be exchanged for another (such as an item like a 'magic sword')—in the present case, within the game—does not make the service that has already been supplied a voucher."

There's more to the opinion before Kokott effectively tells Lithuania's Tax Disputes Commission that it should dumpster this whole situation, but I think the austere quotation marks around "magic sword" makes an appropriate mic drop for this overview.

Interestingly, as my colleague Austin Wood noted over at GamesRadar, Kokott issued her opinion just 5 days before RuneScape developer Jagex declared a strengthened zero-tolerance policy on real-world gold trading, which RuneScape's terms of service "expressly forbid."

"Buying gold off a real world trader is already very clearly against the rules, but historically we've treated the buyers more leniently than the sellers when issuing penalties for real world trading," Jagex said. "As part of our clamp-down on those gold-farming bots and the harm they do to Old School RuneScape, we're now taking a harsher line against players caught buying gold from them. If you're buying your gold that way, please don't expect to get away with just a warning."

It's unclear whether the Jagex's signalling a new War on Gold-selling was in any way a response to Kokott's opinion, but if you're going to be writing your own opinions for the highest court in EU law, you can apparently do worse than pairing Faust quotes with magic swords.

2025 games: This year's upcoming releases

Best PC games: Our all-time favorites

Free PC games: Freebie fest

Best FPS games: Finest gunplay

Best RPGs: Grand adventures

Best co-op games: Better together

Lincoln has been writing about games for 12 years—unless you include the essays about procedural storytelling in Dwarf Fortress he convinced his college professors to accept. Leveraging the brainworms from a youth spent in World of Warcraft to write for sites like Waypoint, Polygon, and Fanbyte, Lincoln spent three years freelancing for PC Gamer before joining on as a full-time News Writer in 2024, bringing an expertise in Caves of Qud bird diplomacy, getting sons killed in Crusader Kings, and hitting dinosaurs with hammers in Monster Hunter.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.