Founder of collapsed crypto exchange FTX arrested in the Bahamas

Sam Bankman-Fried is faced extradition to the US, where he's been formally charged with fraud.

To the surprise of absolutely no one, Sam Bankman-Fried, founder of the collapsed crypto-catastrophe FTX, has been arrested in the Bahamas over "financial offenses" allegedly committed in the Bahamas and the US.

The Office of the Attorney General of the Bahamas said in a statement that Bankman-Fried is being held in custody "pursuant to our nation's Extradition Act," and that the Bahamas will act "promptly" once a formal request for his extradition to the US is made.

The FTX cryptocurrency exchange was valued at $32 billion at the beginning of 2022, but by November the wheels had completely come off. Rumors about trouble at FTX led to a $6 billion run on the company, allegations of gross malfeasance, and an eventual collapse into what John Ray III, the man charged with overseeing FTX's bankruptcy, called the most "complete failure of corporate controls" he's ever seen—and he's the guy who rode herd over the mega-bankruptcies of companies including Enron and Nortel.

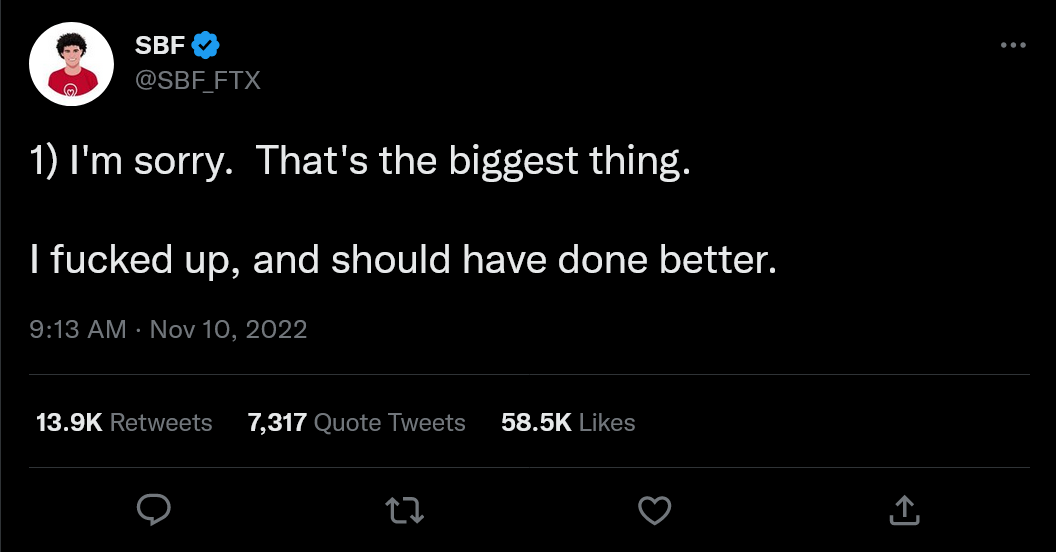

Questions about the role that Bankman-Fried and other executives played in FTX's fast, loose, and potentially illegal handling of investors' money arose almost immediately after the trouble at the company came to light. Bankman-Fried acknowledged in a lengthy Twitter thread that he "fucked up, and should have done better," but has repeatedly denied knowingly taking part in fraud or any other criminal activity.

But it's become clear more recently that, at the very least, there was a tremendous lack of oversight at the company: Records and money are both missing, and Ray, the man in charge of FTX's bankruptcy, said Bankman-Fried "often communicated by using applications that were set to auto-delete after a short period of time, and encouraged employees to do the same." In the world of corporate governance, that is a very, very bad sign.

The US Securities and Exchange Commission seems convinced that Bankman-Fried was up to no good. Today, the day after his arrest, the SEC formally charged him with fraud, and said that other securities law violations could be coming.

"FTX operated behind a veneer of legitimacy Mr. Bankman-Fried created by, among other things, touting its best-in-class controls, including a proprietary 'risk engine,' and FTX’s adherence to specific investor protection principles and detailed terms of service," Gurbir S. Grewal, Director of the SEC's Division of Enforcement, said in a statement. "But as we allege in our complaint, that veneer wasn’t just thin, it was fraudulent."

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

"FTX's collapse highlights the very real risks that unregistered crypto asset trading platforms can pose for investors and customers alike. While we continue to investigate FTX and other entities and individuals for potential violations of the federal securities laws, as alleged in our complaint, today we are holding Mr. Bankman-Fried responsible for fraudulently raising billions of dollars from investors in FTX and misusing funds belonging to FTX's trading customers."

SEC chair Gary Gensler said Bankman-Fried "built a house of cards on a foundation of deception," and said FTX's collapse is "a clarion call to crypto platforms that they need to come into compliance with our laws."

The SEC charges might be Bankman-Fried's biggest problem, but it's not the only one. The US Attorney’s Office for the Southern District of New York and the Commodity Futures Trading Commission have also filed charges against him, and Prime Minister of the Bahamas Philip Davis said the country "will continue its own regulatory and criminal investigations into the collapse of FTX."

On 12 December 2022, the Office of the Attorney General of The Bahamas is announcing the arrest by The Royal Bahamas Police Force of Sam Bankman-Fried (“SBF”), former CEO of FTX. pic.twitter.com/CRNeLPAbVpDecember 12, 2022

It could be a while before this matter is resolved. According to Coindesk, Bankman-Fried said in a court hearing following his arrest that he is not waiving his right to fight extradition to the US.

Along with all the investor cash lost, the collapse of FTX has also contributed to bitcoin miners defaulting on loans, leaving their financers, crypto companies such as NYDIG, with a bunch of mining rigs that have lost a lot of value since they were purchased. Maybe they should've just used them to play Hunt: Showdown or Midnight Suns like the rest of us.

Andy has been gaming on PCs from the very beginning, starting as a youngster with text adventures and primitive action games on a cassette-based TRS80. From there he graduated to the glory days of Sierra Online adventures and Microprose sims, ran a local BBS, learned how to build PCs, and developed a longstanding love of RPGs, immersive sims, and shooters. He began writing videogame news in 2007 for The Escapist and somehow managed to avoid getting fired until 2014, when he joined the storied ranks of PC Gamer. He covers all aspects of the industry, from new game announcements and patch notes to legal disputes, Twitch beefs, esports, and Henry Cavill. Lots of Henry Cavill.