AMD's feeling flush: plans to spend $4B buying back its own shares

AMD's no longer strapped for cash, that's for sure.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Every Friday

GamesRadar+

Your weekly update on everything you could ever want to know about the games you already love, games we know you're going to love in the near future, and tales from the communities that surround them.

Every Thursday

GTA 6 O'clock

Our special GTA 6 newsletter, with breaking news, insider info, and rumor analysis from the award-winning GTA 6 O'clock experts.

Every Friday

Knowledge

From the creators of Edge: A weekly videogame industry newsletter with analysis from expert writers, guidance from professionals, and insight into what's on the horizon.

Every Thursday

The Setup

Hardware nerds unite, sign up to our free tech newsletter for a weekly digest of the hottest new tech, the latest gadgets on the test bench, and much more.

Every Wednesday

Switch 2 Spotlight

Sign up to our new Switch 2 newsletter, where we bring you the latest talking points on Nintendo's new console each week, bring you up to date on the news, and recommend what games to play.

Every Saturday

The Watchlist

Subscribe for a weekly digest of the movie and TV news that matters, direct to your inbox. From first-look trailers, interviews, reviews and explainers, we've got you covered.

Once a month

SFX

Get sneak previews, exclusive competitions and details of special events each month!

AMD may have money burning a hole in its pockets, as the Ryzen and Radeon maker announces a program to repurchase $4B worth of its own shares.

What that means is AMD is looking to bolster its share price by buying up some of the shares it has issued over the years. The fewer shares in the open market, the less diluted the share pool, the higher the value of each share. Capeesh?

"Today's announcement reflects our confidence in AMD's business and the successful execution of our multi-year growth strategy," Dr. Lisa Su, AMD president and CEO, says. "Our strong financial results and growing cash generation enable us to invest in the business and begin returning capital to our shareholders."

It makes sense for a company in its prime who wants to push up its share price, and invest in its own value while rewarding its shareholders, whose shares will go up in value as and when AMD buys back large quantities of shares.

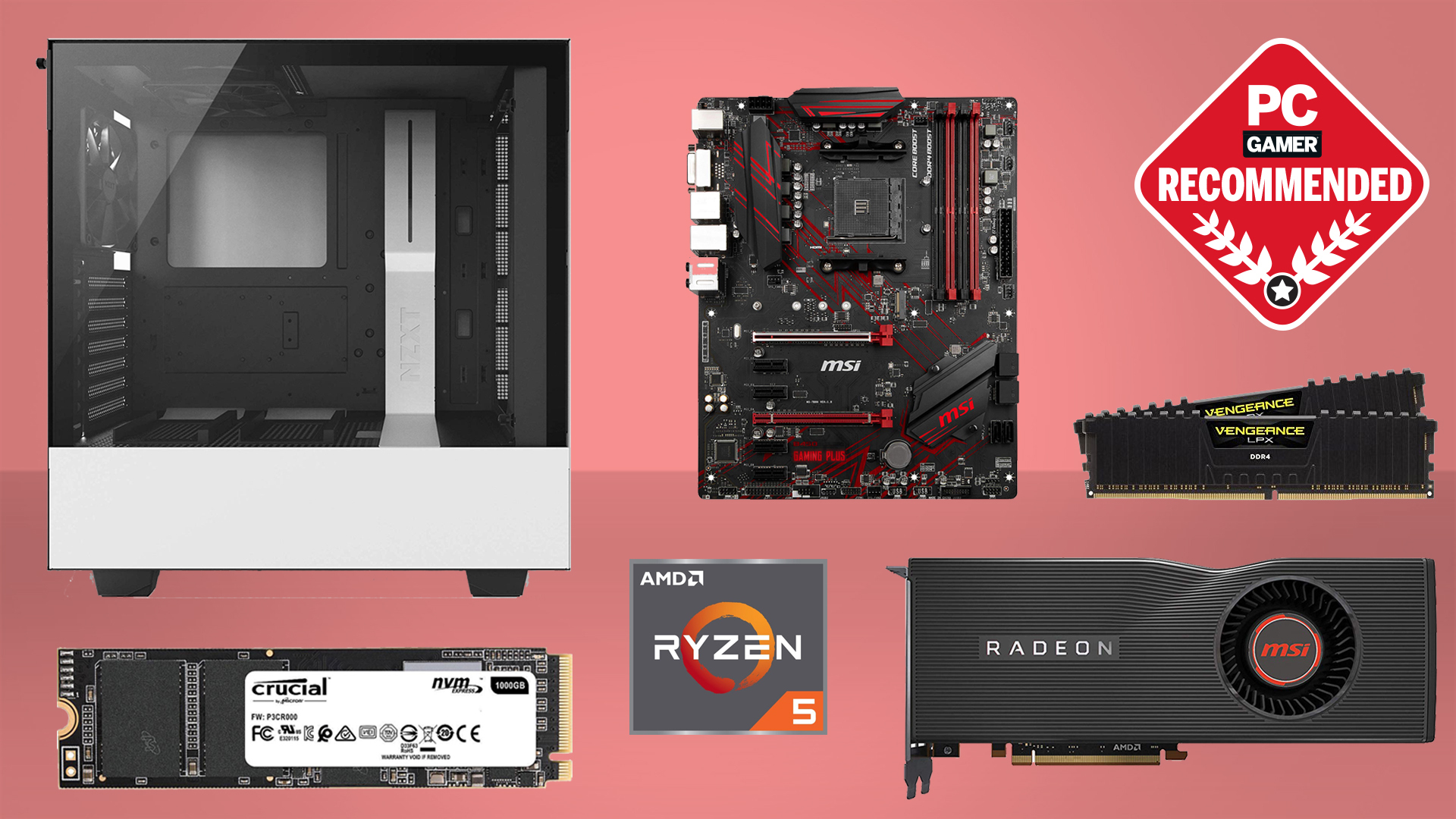

Best CPU for gaming: the top chips from Intel and AMD

Best graphics card: your perfect pixel-pusher awaits

Best SSD for gaming: get into the game ahead of the rest

The total value of AMD's outstanding shares, its market cap, is currently a little over $92B. That's subject to change over the years, however—ideally AMD will want that to go up, meaning how many shares AMD can buy back with its $4B will change over time. It's quite a few, anyways.

There's no doubt that AMD is riding high after some of its best years in the company's history. The company's revenue for the first three months of 2021 was $3.45B, an increase of 93% year on year

And Dr. Lisa Su is clearly keen on putting that right back into the biz. Not only with this buyback scheme but also AMD's recent $35B acquisition of Xilinx.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

Jacob earned his first byline writing for his own tech blog, before graduating into breaking things professionally at PCGamesN. Now he's managing editor of the hardware team at PC Gamer, and you'll usually find him testing the latest components or building a gaming PC.