The IRS may want to tax your V-Bucks

A reference to the Fortnite currency has been removed from the IRS website, but the question on the tax form remains.

There's an old saying that the only two certainties in life are death and taxes. It's an adage that the Internal Revenue Service in the US appears particularly committed to. A CNN report has revealed that the IRS website specifically cited Fortnite's V-Bucks and Robux from Roblox as digital currencies that could be subject to "tax consequences."

The reference to V-Bucks has since been removed, but it was in place since at least October 2019 and can still be seen via the Wayback Machine.

"Virtual currency that has an equivalent value in real currency, or that acts as a substitute for real currency, is referred to as 'convertible' virtual currency. Bitcoin, Ether, Roblox, and V-bucks are a few examples of a convertible virtual currency," the Virtual Currencies page said prior to the change. "Virtual currencies can be digitally traded between users and can be purchased for, or exchanged into, U.S. dollars, Euros, and other real or virtual currencies."

The current version of the page removes all examples except Bitcoin, but maintains an identical description of potential "tax consequences" applicable to virtual currencies.

"The sale or other exchange of virtual currencies, or the use of virtual currencies to pay for goods or services, or holding virtual currencies as an investment, generally has tax consequences that could result in tax liability," the pages state. "The IRS issued IRS Notice 2014-21, IRB 2014-16, as guidance for individuals and businesses on the tax treatment of transactions using virtual currencies. The IRS also published Frequently Asked Questions on Virtual Currency Transactions for individuals who hold cryptocurrency as a capital asset and are not engaged in the trade or business of selling cryptocurrency."

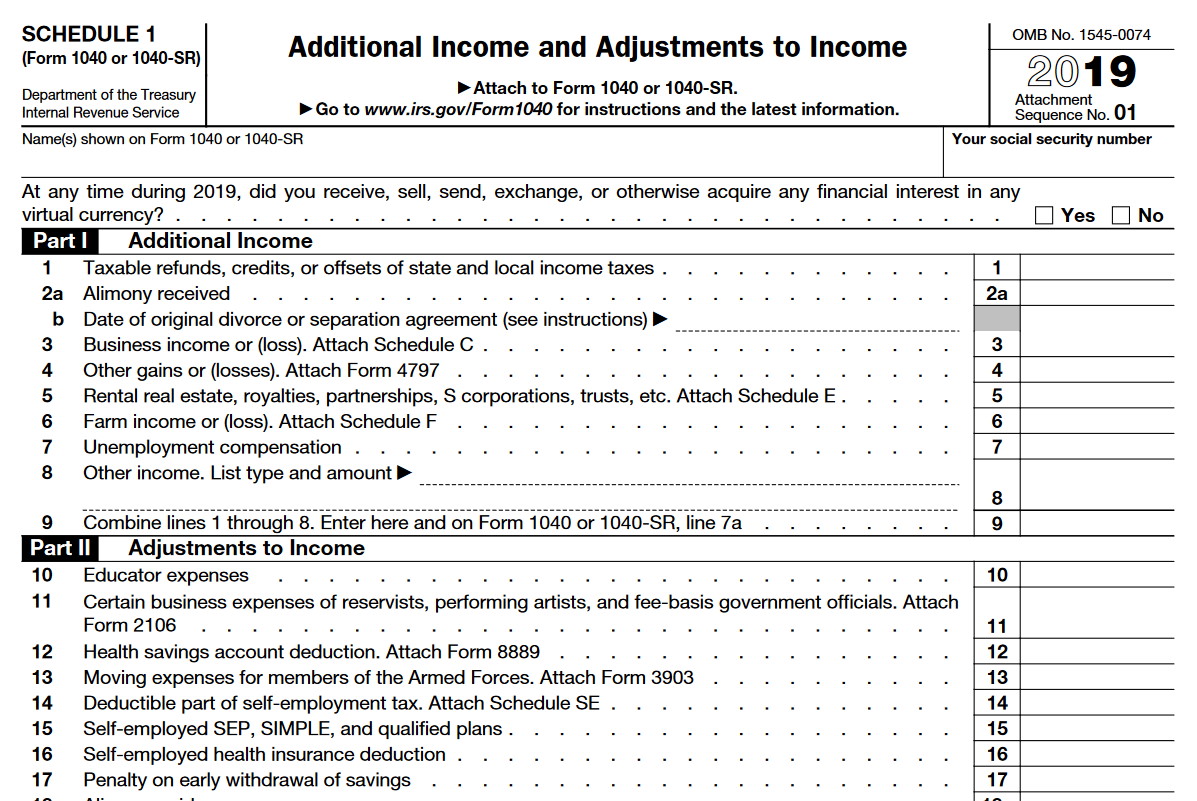

The change in wording does not necessarily mean a change in the mechanics, however. As reported by Bloomberg, IRS chief counsel Michael Desmond said that the inclusion of game currencies was a mistake, but Jerry Brito, executive director of the cryptocurrency research and advocacy non-profit Coin Center, told the site that a new question on the 1040 form for 2019—"At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?"—could lead to trouble, or at least confusion, for an awful lot of taxpayers.

"I think a lot of people aren’t going to know that they have to answer 'yes,' so they’re going to answer no'," he said.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

An Epic rep said that V-Bucks should be exempt from the definition of virtual currency, and thus taxation, because they cannot be traded between players or cashed out. The Roblox currency Robux can be cashed out under specific conditions, but its taxation requirements are also laid out up-front.

"Robux can only be earned and exchanged by developers for real currency through our Developer Exchange (DevEx) program," a Roblox rep said. "Prior to any payments being made to developers, we require them to have an IRS form on file with Roblox, and we report all DevEx payments to the IRS using form 1099."

Jackson Hewitt chief tax officer Mark Steber said that the reference to V-Bucks and other game-related currencies may have been removed because it wasn't "particularly accurate," and that answering "yes" will not necessarily require you to do anything else. But he also noted that it's likely a sign that the IRS will be putting a greater focus on virtual currencies in the future.

"More guidance, more rules, more requirements, more oversight and monitoring by the IRS," he said. "It's no longer something that's going to live in the background shadows. There's too much money there."

Andy has been gaming on PCs from the very beginning, starting as a youngster with text adventures and primitive action games on a cassette-based TRS80. From there he graduated to the glory days of Sierra Online adventures and Microprose sims, ran a local BBS, learned how to build PCs, and developed a longstanding love of RPGs, immersive sims, and shooters. He began writing videogame news in 2007 for The Escapist and somehow managed to avoid getting fired until 2014, when he joined the storied ranks of PC Gamer. He covers all aspects of the industry, from new game announcements and patch notes to legal disputes, Twitch beefs, esports, and Henry Cavill. Lots of Henry Cavill.