Ryzens and Radeons revitalise AMD's revenues but export restrictions delete data center profits, causing share prices to slip

Believe it or not, Dell's had a say in the matter, too.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Every Friday

GamesRadar+

Your weekly update on everything you could ever want to know about the games you already love, games we know you're going to love in the near future, and tales from the communities that surround them.

Every Thursday

GTA 6 O'clock

Our special GTA 6 newsletter, with breaking news, insider info, and rumor analysis from the award-winning GTA 6 O'clock experts.

Every Friday

Knowledge

From the creators of Edge: A weekly videogame industry newsletter with analysis from expert writers, guidance from professionals, and insight into what's on the horizon.

Every Thursday

The Setup

Hardware nerds unite, sign up to our free tech newsletter for a weekly digest of the hottest new tech, the latest gadgets on the test bench, and much more.

Every Wednesday

Switch 2 Spotlight

Sign up to our new Switch 2 newsletter, where we bring you the latest talking points on Nintendo's new console each week, bring you up to date on the news, and recommend what games to play.

Every Saturday

The Watchlist

Subscribe for a weekly digest of the movie and TV news that matters, direct to your inbox. From first-look trailers, interviews, reviews and explainers, we've got you covered.

Once a month

SFX

Get sneak previews, exclusive competitions and details of special events each month!

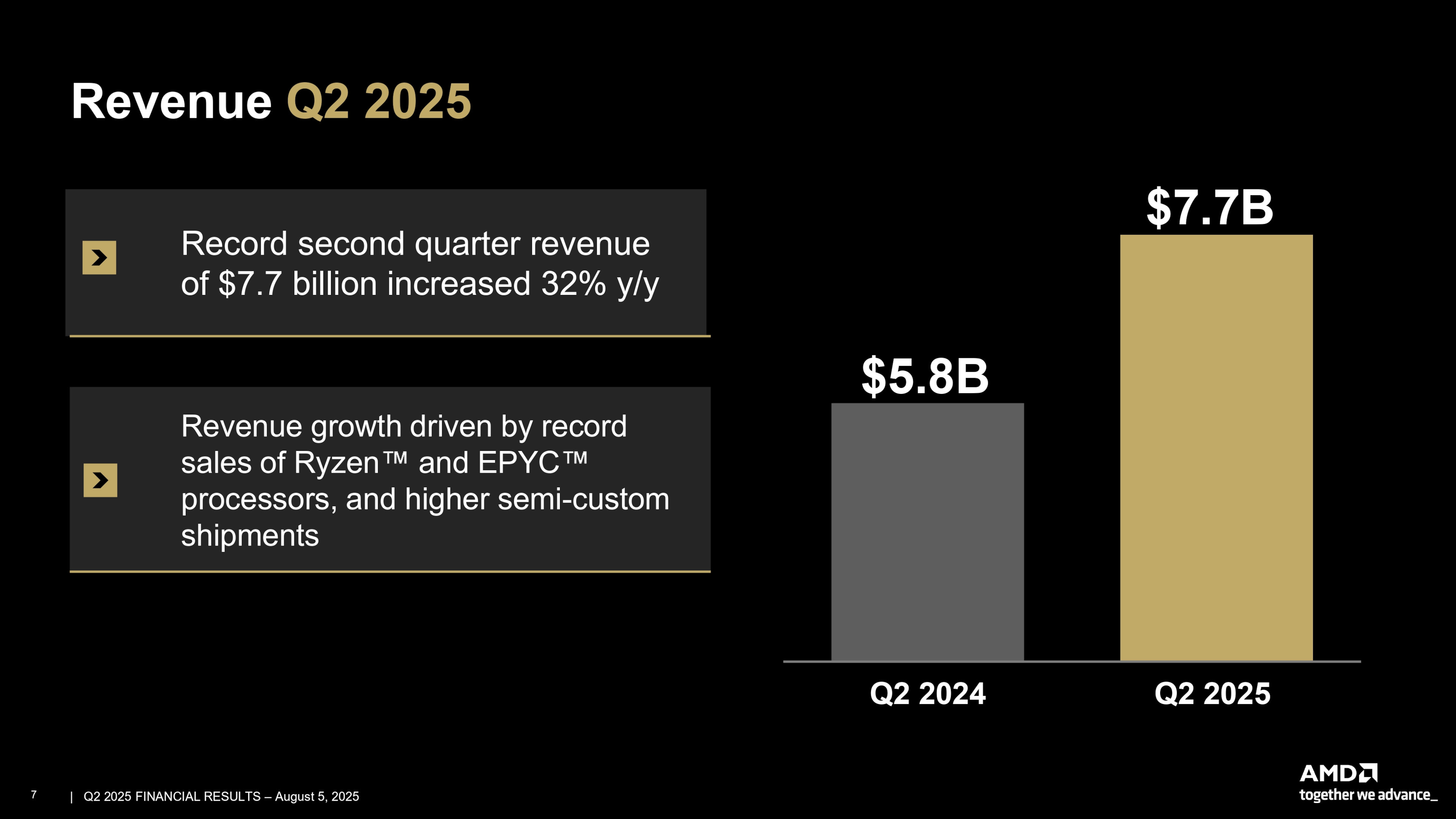

If you're a fan of AMD and its red-hued CPUs and graphics cards, you'll be pleased to know that the huge demand for Ryzens and Radeons has done wonders for its streams of income. In its latest financial report, AMD says that its total revenue of $7.7 billion is 32% better than this time last year. However, export restrictions on its mega-bucks AI processors have resulted in its data center division making a loss for the first time in six months.

You can skim over the details yourself in the Q2 financial report summary, and at first glance, you might be puzzled as to why AMD's share prices have fallen since the release of the data.

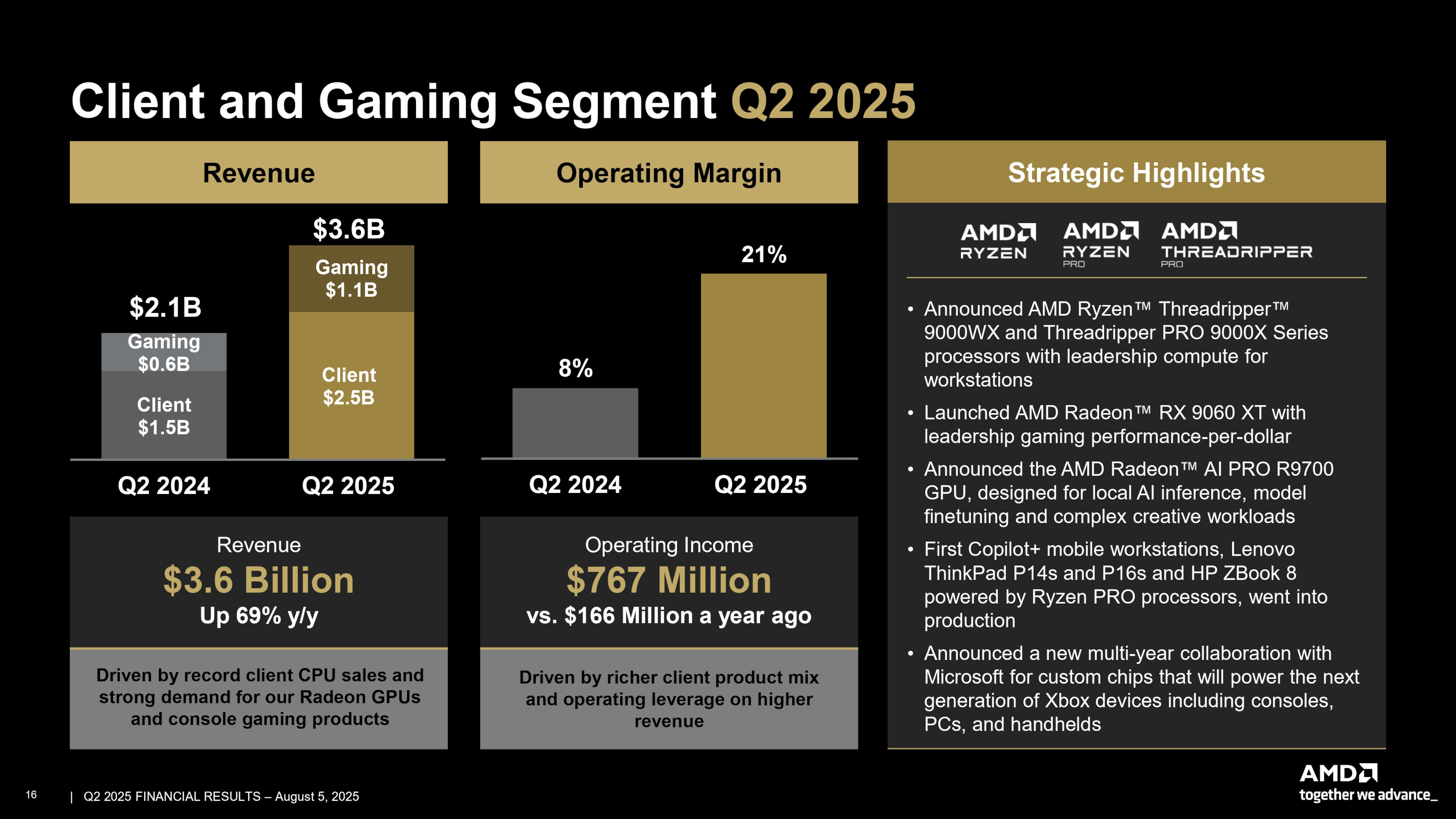

After all, the Client and Gaming Division—covers all Ryzen CPUs, desktop and mobile, Radeon GPUs, and semi-custom chips—has been doing extremely well. Revenue for this sector is up 69% compared to Q2 2024, with a split of $2.6 billion for Client and $1.1 billion for Gaming.

The latter is actually 73% better than last year, thanks to "an increase in semi-custom revenue and strong AMD Radeon GPU demand." And it's not just PC gamers buying Ryzen 7 9800X3D CPUs and Radeon RX 9070 XT graphics cards that's helping to fill the coffers, as AMD says that a "significant uptick" in sales of Dell PCs with Ryzen processors helped in no small way.

Business and commercial PCs have traditionally been Intel's domain, but the whole Crashgate affair with Raptor Lake, the underwhelming response to Arrow Lake, and general concerns over Team Blue's future will have certainly given OEM and system builders the heebie-jeebies. Any hopes that Qualcomm's Snapdragon processors would be the perfect alternative to x86 chips have also faded.

That's booted the door wide open for AMD to stomp in, wave its chiplets about, and grab all the contracts it can.

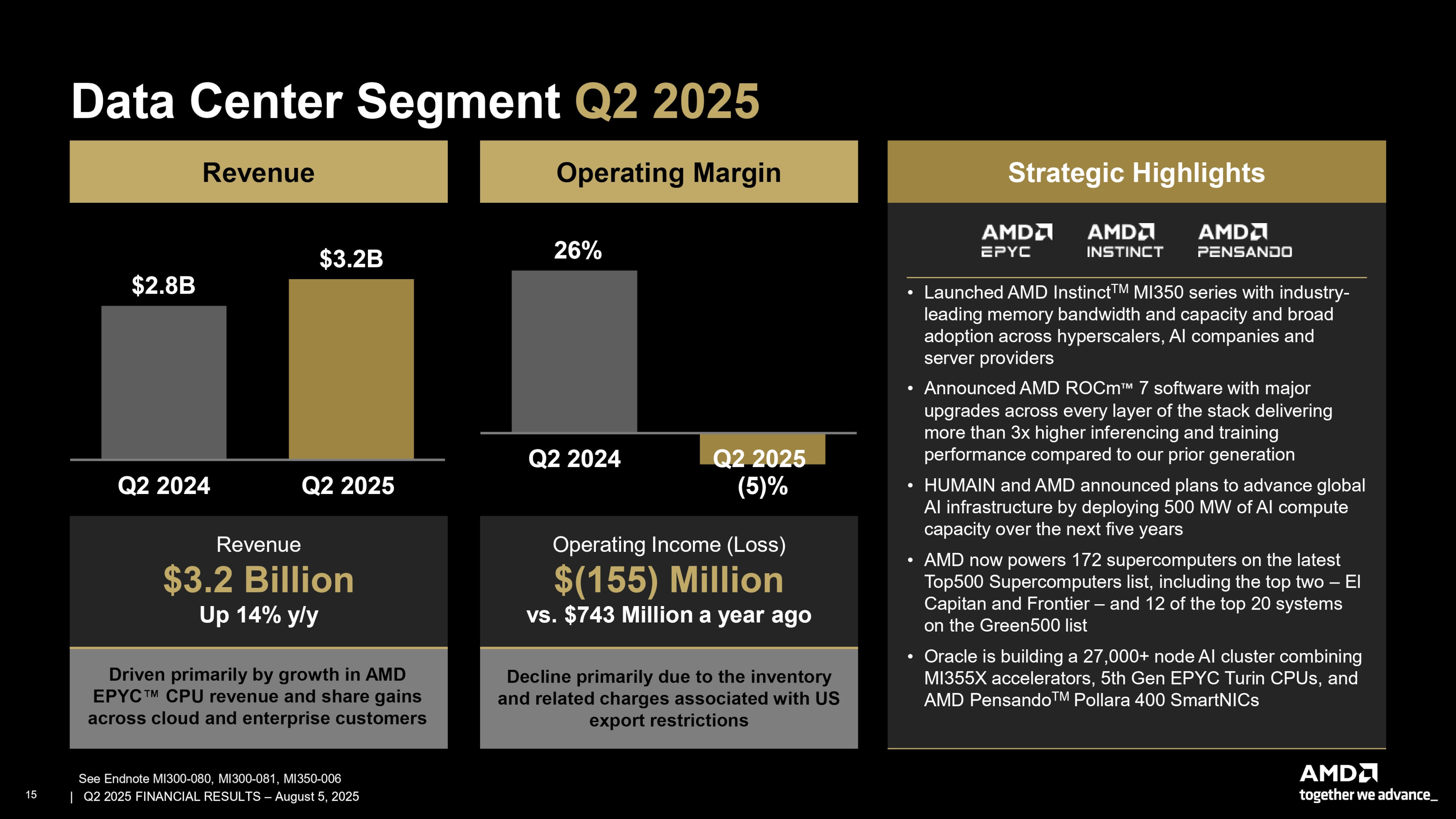

Its data center division has also enjoyed improved revenues, albeit nothing like as big a jump as with C&G, coming in at 14% better than last year. The total income was $3.2 billion, but the operating income was a loss of $155 million, in part due to US export restrictions on its MI308 data center GPUs. "These restrictions led to approximately $800 million in inventory and related charges," AMD says.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

The relatively small revenue increase, the inventory cost, and the fact that Nvidia's data center revenues are in another league entirely are why AMD's shares took a small tumble after the financial announcement.

Not that this seems to be worrying Team Red in the least bit, as it expects revenues to continue improving—predicting a Q3 total of $8.6 billion—and if it can get the nod to start selling AI chips to China again, then the money is really going to start rolling in.

👉Check out our list of guides👈

1. Best CPU: AMD Ryzen 7 9800X3D

2. Best motherboard: MSI MAG X870 Tomahawk WiFi

3. Best RAM: G.Skill Trident Z5 RGB 32 GB DDR5-7200

4. Best SSD: WD_Black SN7100

5. Best graphics card: AMD Radeon RX 9070

Nick, gaming, and computers all first met in the early 1980s. After leaving university, he became a physics and IT teacher and started writing about tech in the late 1990s. That resulted in him working with MadOnion to write the help files for 3DMark and PCMark. After a short stint working at Beyond3D.com, Nick joined Futuremark (MadOnion rebranded) full-time, as editor-in-chief for its PC gaming section, YouGamers. After the site shutdown, he became an engineering and computing lecturer for many years, but missed the writing bug. Cue four years at TechSpot.com covering everything and anything to do with tech and PCs. He freely admits to being far too obsessed with GPUs and open-world grindy RPGs, but who isn't these days?

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.