Oracle will shop around for AI chips after adopting a policy of 'chip neutrality'… but of course it'll still buy the latest Nvidia GPUs

AMD sales team, assemble!

Oracle is looking beyond Nvidia for the chips it needs to power its AI datacenters. In what could be described as a warning shot to Jensen Huang's business, Oracle co-founder Larry Ellison said: "We are now committed to a policy of chip neutrality where we work closely with all our CPU and GPU suppliers."

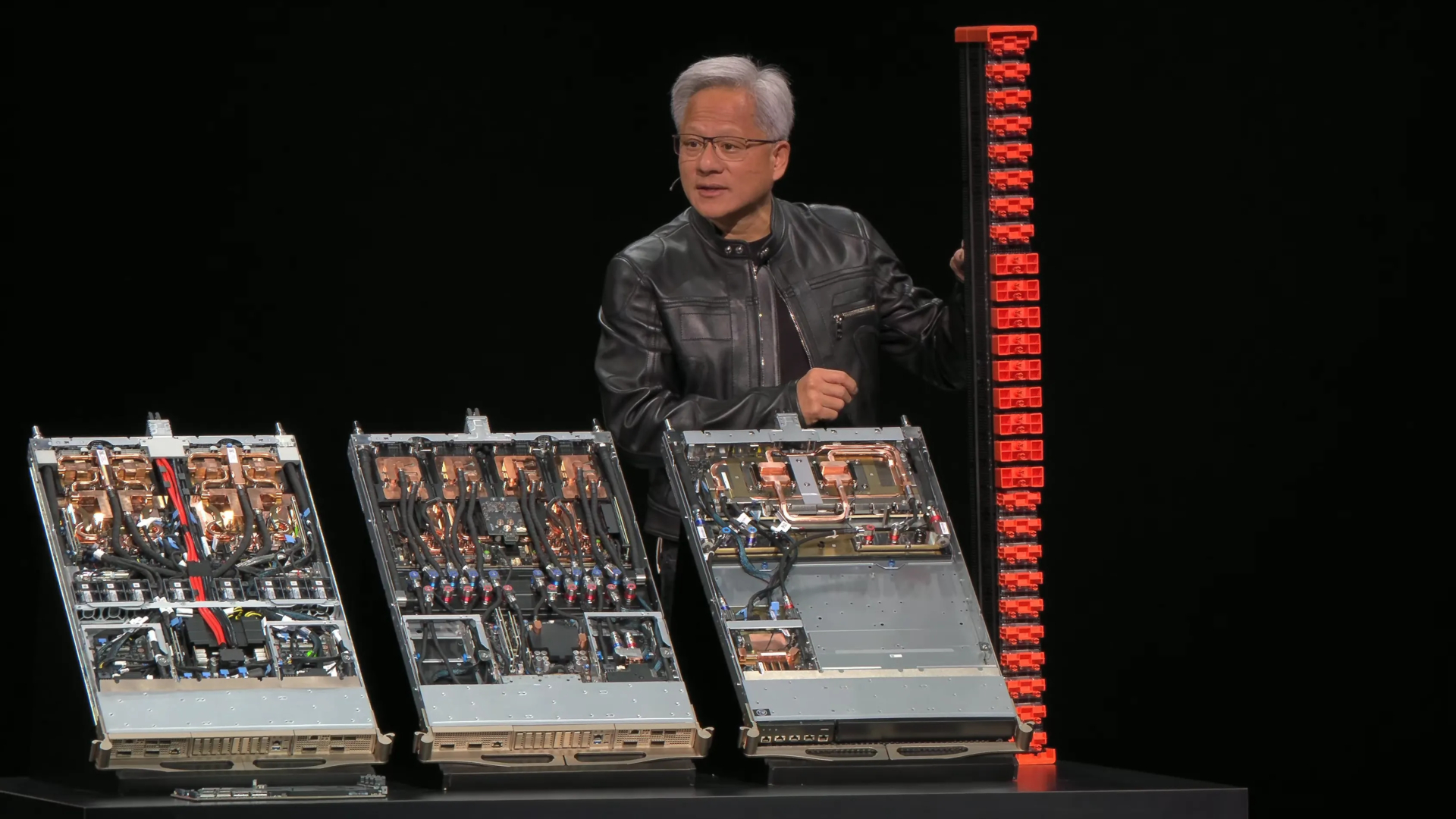

In Oracle's latest financials, Ellison said: "Of course, we will continue to buy the latest GPUs from Nvidia, but we need to be prepared and able to deploy whatever chips our customers want to buy. There are going to be a lot of changes in AI technology over the next few years and we must remain agile in response to those changes."

That might be good news for AMD. The only other company with a mature graphics division, Dr. Lisa Su's company has been trying to follow in Nvidia's wake with its own lineup of AI accelerators, including the MI350 Series and future MI400 and MI500-series cards. It's these alternatives to Blackwell and next-gen Rubin that a lot of companies will be pinning their hopes of side-stepping Nvidia and whatever remains of its 'the more you buy, the more you save' mentality.

Though there are other options: Google has its Tensor Processing Units and OpenAI is in partnership with Broadcom to design its own chips. Oracle very recently owned a large share of Arm's datacentre chip design business, Ampere, but sold it to Japanese investment company, SoftBank, which retains a majority ownership of Arm.

"Oracle sold Ampere because we no longer think it is strategic for us to continue designing, manufacturing and using our own chips in our cloud datacenters," Ellison said of the move.

Oracle just announced its 2026 Q2 results—at a certain point businesses grow too powerful to be constrained by the Gregorian calendar—and it has announced huge increases in its quarterly revenue. Up 14%. The company made $16.1 billion in three months. But hey, that's actually a bad thing. The company's share price has plummeted 10% since the announcement.

You may know Oracle from its cloud computing and database software. Or, if you grew up in the early 2000s, you may remember its logo appearing on the Java installer after the company bought Sun Microsystems. So, yeah, that company is being awarded lots of big contracts from companies looking to expand into AI.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

Oracle is one of the companies at the heart of the artificial intelligence boom. It has datacenters all over the globe, but more than that, it works with other massive cloud providers such as Google and Microsoft to offer their services. It has fingers in many pies. As such, it lives and dies by the idea that AI is actually worth all of the money being pumped into it.

Oracle is spending lots of time and money on meeting the demands of AI, and this hasn't turned into lots more revenue in the short-term. While Oracle had made lots of money this previous quarter, analysts had expected more. Bloomberg suggests the company has around $106 billion in debt, adding around $10 billion to that in the previous quarter with a negative free cash flow—so, Oracle needs more money, or needs the investments it's making with this money to pay off.

Essentially, we're back to the bubble again. Big spending equals big risk, and some are more bullish on AI than others. The investor that predicted the financial crisis in 2008, and earning fame through the adaption of those events in the movie, The Big Short, has already bet against Nvidia and Palantir, for example.

1. Best overall: AMD Radeon RX 9070

2. Best value: AMD Radeon RX 9060 XT 16 GB

3. Best budget: Intel Arc B570

4. Best mid-range: Nvidia GeForce RTX 5070 Ti

5. Best high-end: Nvidia GeForce RTX 5090

Jacob earned his first byline writing for his own tech blog, before graduating into breaking things professionally at PCGamesN. Now he's managing editor of the hardware team at PC Gamer, and you'll usually find him testing the latest components or building a gaming PC.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.