After GameStop's share price plummets, Reddit's WallStreetBets investors are hurting

"I just want my money back but I know it is gone."

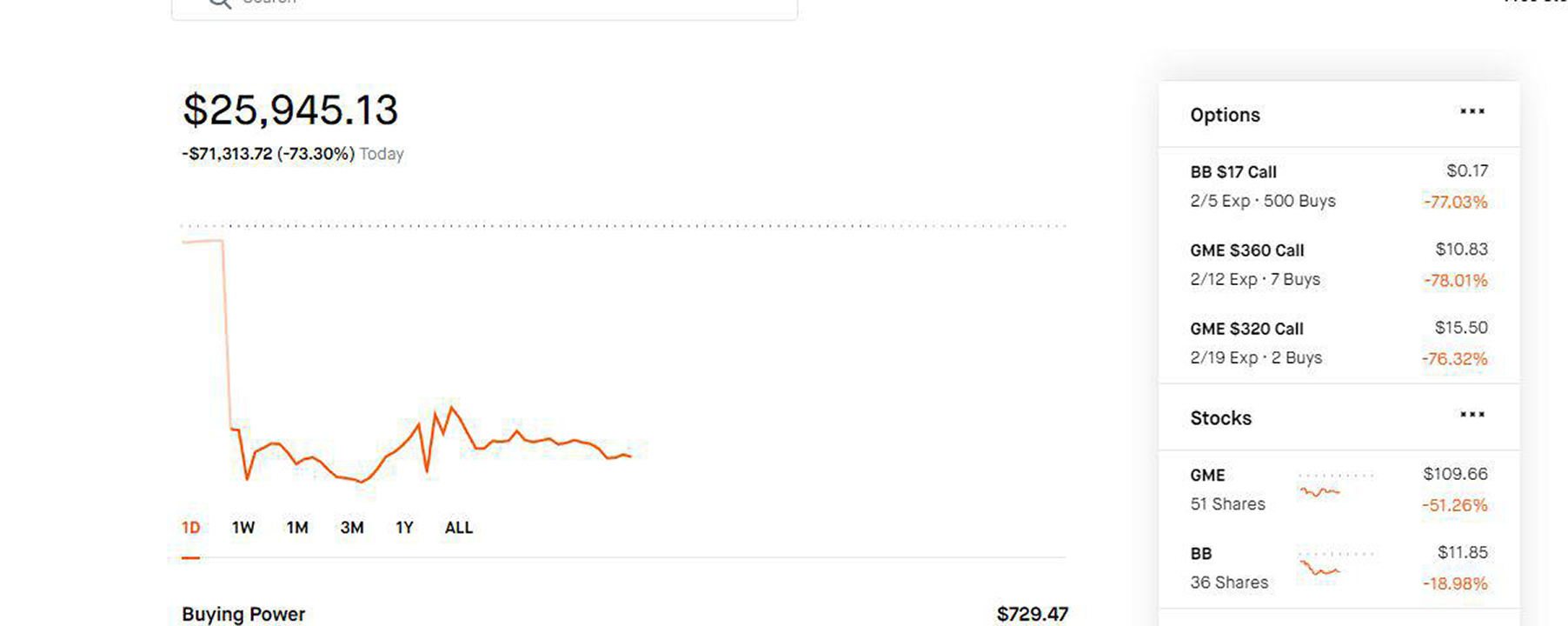

The wild GameStop ride that began more than a week ago has taken a devastating turn. After peaking at a share price of $483 last week and holding reasonably steady through a controversial suspension of service by several popular retailer investor apps like Robinhood, the company's share value has today plummeted to just $82. While that's still a 400 percent increase over its value at the beginning of January, some investors who got swept up in the Reddit-driven hype are now facing potentially staggering losses.

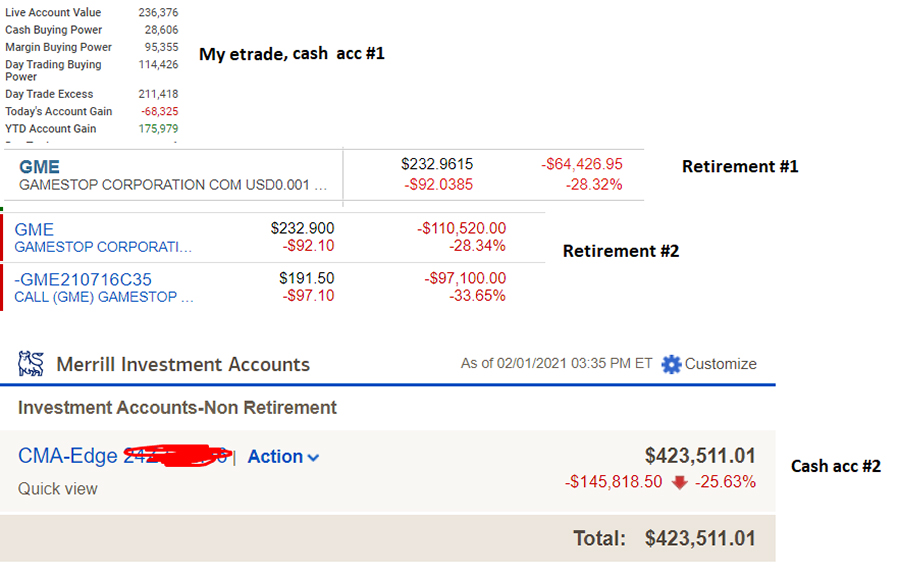

"I just want my money back but I know it is gone," wrote an investor from the Wallstreet Bets Discord named Slik, a 52-year-old Nevada resident. On Friday, Slik had invested $1.1 million in options on GameStop stock and lost $850,000. "I just didn't spend enough time to research what I was doing, or what the market could do to my account so quickly."

It’s more than just money. It’s about exposing how fucked up the stock market is.

Housecat

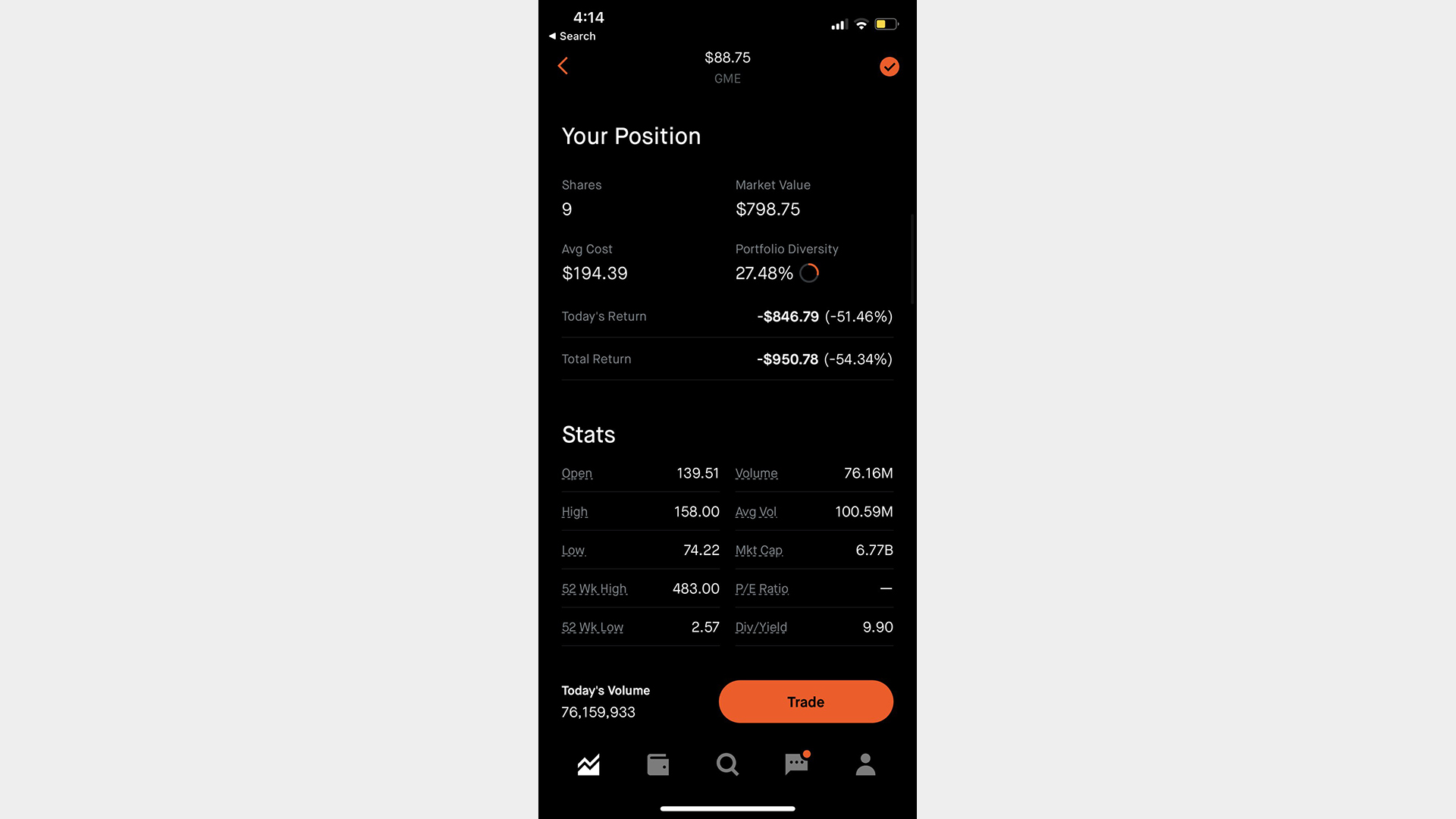

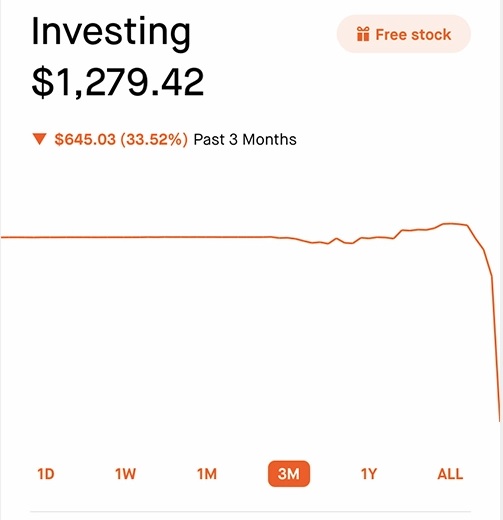

"My income is low, and this stonk sinking this low after buying it so high is a big hit," another Discord user named Housecat said. They only bought two shares priced at $316, but say that was $632 they really needed. "I’m hurtin [right now]. Not nearly as bad as others, but it’s not great. Luckily I’m in the military and I’m not married, so my expenses are low, don’t have many bills. But I will have to cut back on how often I eat out, or when I buy groceries. It’ll be a lot of playing video games and going to the gym to prevent spending any money for now. Just have to recover from the losses."

It's a sentiment shared by thousands on the Discord and subreddit, where users are frequently lamenting their losses while others spam "Hold the line" into chat like a war cry. On Twitter, a user named Shane explained they had initially bought shares when GME was listed at around $390. After buying more at lower prices, now owning just seven shares, they were facing the reality that their investment of $1550 might be burnt. "After this experience day trading, the second I can pull out for some profit I’m likely never going to day trade and do this stuff again because it was highly stressful and not worth it by any means," they said.

PC Gamer has spoken to half a dozen investors whose losses ranged from a few thousand to $850,000. All of whom say they are upset by the sudden downturn in GameStop share price.

This is the outcome that some financial industry experts and casual observers alike have been warning of since Reddit first took notice of GameStop: That individuals caught up in the moment and without a full understanding of what they were getting into could end up badly hurt after the share price turned south. Forbes underlined the urgency of those warnings today with a report bluntly entitled, "Please sell GameStop before it round trips."

Despite those warnings, and the precipitous decline in GameStop's price, not everyone is ready to throw in the towel yet. One of the defining aspects of the Wallstreetbets community in recent weeks has been an almost cultlike devotion to fighting the hedge funds that had initially shorted on GameStop's stock. Like soldiers in a battle, users encourage each other to "hold the line" and "trust in the plan," instead of cutting their losses. One thread on Reddit is filled with people claiming that they're taking the opportunity to buy even more shares as GameStop continues to slide. "They're handing us a discount to buy more, how thoughtful," one user wrote. "I just bought four more shares. If they want to give me a discount, I'll take it," said another.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

And there are others who, at least publicly, share that optimism. Billionaire investor and Dallas Mavericks owner Mark Cuban, for one, encouraged people with holdings in the company to hang onto them. "Best thing you can do is hold on to the stock and do business with GameStop. If everyone goes to their website and buys from them that is going to help the company which will help the stock which will help everyone here," he wrote today in a Reddit AMA. "If you still believe in the reason you bought the stock, and that hasn't changed, why sell?"

Cuban said he believes Robinhood's decision to restrict access to GameStop last week stock triggered the price drop by cutting off access to a significant portion of buyers, forcing sellers to lower their price in order to attract other potential investors. That created what he called a "Robinhood Dive," he continued, because the lower it goes, the more that investors who bought on margin are forced to sell, or put more money into their broker's account in order to ensure that it's kept at a minimum value, an action known as a "margin call."

"When that margin call happens, it's brutal. They just take your stock, send you a fuck-you note and sell your stock at the market price, no matter how low. They just want to get your cash to pay back the loan," Cuban said. "That then accelerates the selling. Which then leads to what we are seeing in the market right now with GME in particular."

The upside for individual investors, he continued, is that once online brokers like Robinhood fully restore access to GameStop, "then we will see what WSB is really made of. That is when you get to make it all work."

"I know you are going to hate to hear this, but the lower it goes, the more powerful WSB can be stepping up to buy the stock again," he said. "The only question is what broker do you use. Do you stay with RH, who is going to have the same liquidity problems over and over again, or do you as a group find a broker with a far, far, far better balance sheet that won’t cut you off and then go ham on Wall Street."

Those words of encouragement are little consolation for those who have lost hundreds of thousands. In the case of Slik, that $850,000 loss is going to ruin his family's event-planning business. He told me he began investing late last year to try and negate the financial damage caused by the coronavirus pandemic, but his mistake to invest in options on GameStop shares without doing more research now means he's likely going to have to lay off 50 employees. "I'm going to be honest with you, I have not slept in three days so I haven't really thought about it properly," he said.

For some individual investors, however, rebelling against Wall Street remains a powerful motivating factor. Housecat, the Discord user who said his losses were a "big hit," said that despite it all he's "holding 'til it kills me."

"It’s more than just money," he continued. "It’s about exposing how fucked up the stock market is, and how it’s okay when the little guys are losing money in the market, but when the hedgies start losing billions, they manipulate the market in order to make money back."

But while major investors can afford to take the risk (and absorb the losses), there are signs that a rougher reality is creeping in for some. "I'll hold because I can't lose this money,” one WallStreetBets user wrote. “But I'm scared."

Andy has been gaming on PCs from the very beginning, starting as a youngster with text adventures and primitive action games on a cassette-based TRS80. From there he graduated to the glory days of Sierra Online adventures and Microprose sims, ran a local BBS, learned how to build PCs, and developed a longstanding love of RPGs, immersive sims, and shooters. He began writing videogame news in 2007 for The Escapist and somehow managed to avoid getting fired until 2014, when he joined the storied ranks of PC Gamer. He covers all aspects of the industry, from new game announcements and patch notes to legal disputes, Twitch beefs, esports, and Henry Cavill. Lots of Henry Cavill.