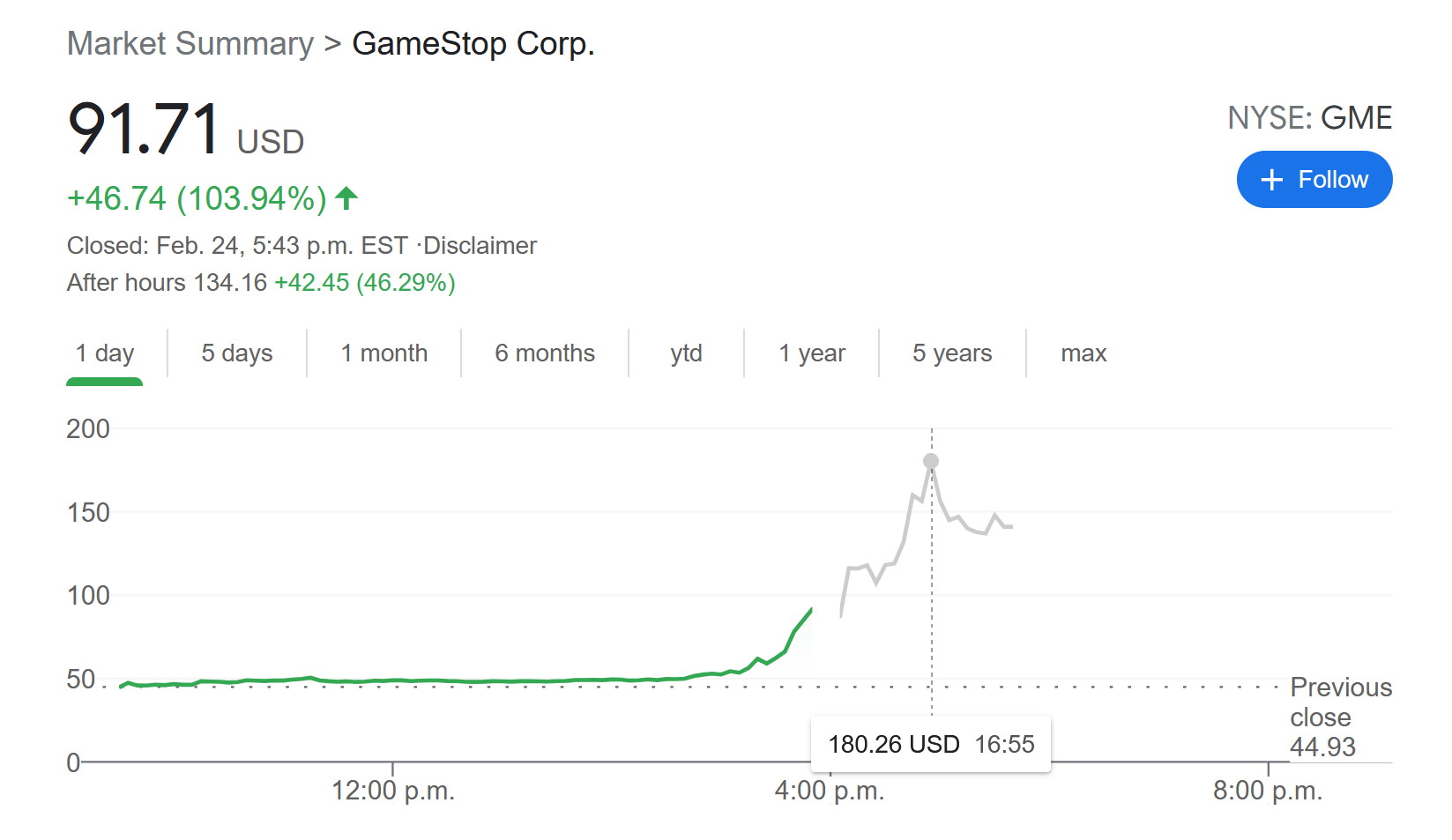

Here we go again? GameStop's share price bounces back to $180

The company's price broke $90 today, then continued to surge in after-hours trading.

In January, GameStop's share price began a wild ride that took it from its usual sub-$20 price to an astonishing high of $483. By early February, the excitement was over: GameStop's price had settled into the more normal price in the $40-$50 range, and while some people made a bundle, many others—generally individual retail investors who missed the moment but got caught up in the hype—took big losses. It was enough to spur a Congressional hearing on the matter.

Now it appears to be happening again. The day after GameStop announced that chief financial officer Jim Bell will resign in March, the stock surged again, breaking $91 before trading was halted at 4 pm ET, and then continuing to climb to a high of $185 in after-hours trading.

The announcement of Bell's departure came as something of a surprise, as he took on the CFO role less than two years ago, in June 2019, and the company doesn't have a replacement lined up. GameStop said in an SEC filing that Bell's resignation "was not because of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices," but sources told Business Insider (via CNBC) that he was pushed out by Chewy co-founder Ryan Cohen, who bought a stake in the company and began advocating for changes in how it operates last summer. Cohen's investment was actually credited with sparking the initial revival of GameStop's share price, several months prior to the Reddit episode.

His ouster is expected to make it easier for Cohen to implement his vision for the company, and some have credited that for the rise in the company's price. It's also been suggested, perhaps not quite so seriously, that this bizarre tweet of a photo of a McDonald's ice cream cone is some kind of hidden signal that's touched off the frenzy.

🐸 pic.twitter.com/ZAjoViGUmjFebruary 24, 2021

Whatever the reason, the sudden surge has sparked celebration on the WallStreetBets subreddit, where users are anticipating another short squeeze and encouraging one another to buy and hold the stock.

Looks like short squeeze back on the menu boys! Buy and HOLD 💎🙌💎 from r/wallstreetbets

It may or may not be related to the matter at hand, but Keith Gill, also known as Reddit investor deepfuckingvalue and finance YouTuber Roaring Kitty (and who testified in the recent Congressional hearing), tweeted this after trading closed for the day.

(I very strongly suspect it is related.)

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

pic.twitter.com/QRrHFAPpePFebruary 24, 2021

It's impossible to say at this point whether this is a continuation of the phenomenon that drove GameStop's explosive price climb in January, or the result of something entirely new, but at the very least there's no denying the superficial similarities. Tomorrow will be very interesting: Will the price continue to go up and perhaps even surpass the record high it set in January, or will this prove to be a relatively short-lived blip? We'll be keeping our eyes on it for sure.

Andy has been gaming on PCs from the very beginning, starting as a youngster with text adventures and primitive action games on a cassette-based TRS80. From there he graduated to the glory days of Sierra Online adventures and Microprose sims, ran a local BBS, learned how to build PCs, and developed a longstanding love of RPGs, immersive sims, and shooters. He began writing videogame news in 2007 for The Escapist and somehow managed to avoid getting fired until 2014, when he joined the storied ranks of PC Gamer. He covers all aspects of the industry, from new game announcements and patch notes to legal disputes, Twitch beefs, esports, and Henry Cavill. Lots of Henry Cavill.