Memory chip specialist SK Hynix reports record-breaking profits but doesn't have a word to say about almost anything apart from AI

AI, AI, oh.

2025 was a bumper year for Korean memory specialist SK Hynix. In fact, the latest financial results show it was the company's best year ever. Do I even have to explain why? OK, it's AI, of course.

But first, the bald numbers. SK Hynix raked in 97 trillion KRW in revenues in 2025. That's about $67 billion dollars in old money. Profits, meanwhile, hit $33 billion, giving the company stellar operating margins of 49%.

Compared to 2024, revenues climbed by 47%. However, profits slightly more than doubled. Long story short, SK Hynix didn't just sell more stuff. It made more money on every sale.

This does not exactly come as a surprise. The prices of pretty much all memory-related products have been spiralling upwards of late. But the cost of producing memory products has surely not increased as much. The result, pretty obviously from SK Hynix's published results, is that a lot more money is being made on each memory chip.

So, apart from the obvious upside for SK Hynix's shareholders, is there any good news here? The company did talk about the investments it is making in production capacity.

"Having successfully completed the preparation stages to mass produce HBM4 – for the first time in the industry – in September last year, the large-scale production of the next-generation HBM has been underway to meet customer requests," SK Hynix said.

Of course, HBM is really only relevant for servers and AI farms, so what about regular old DRAM as used in PCs? "For conventional DRAM, SK Hynix intends to accelerate the transition to the 1 cnm process [that's essentially a 10nm class node], expanding its AI memory product portfolio to include solutions like SOCAMM2 and GDDR7," it said.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

Again, that's mostly an AI and enterprise message, albeit Nvidia uses GDDR7 for gaming graphics cards.

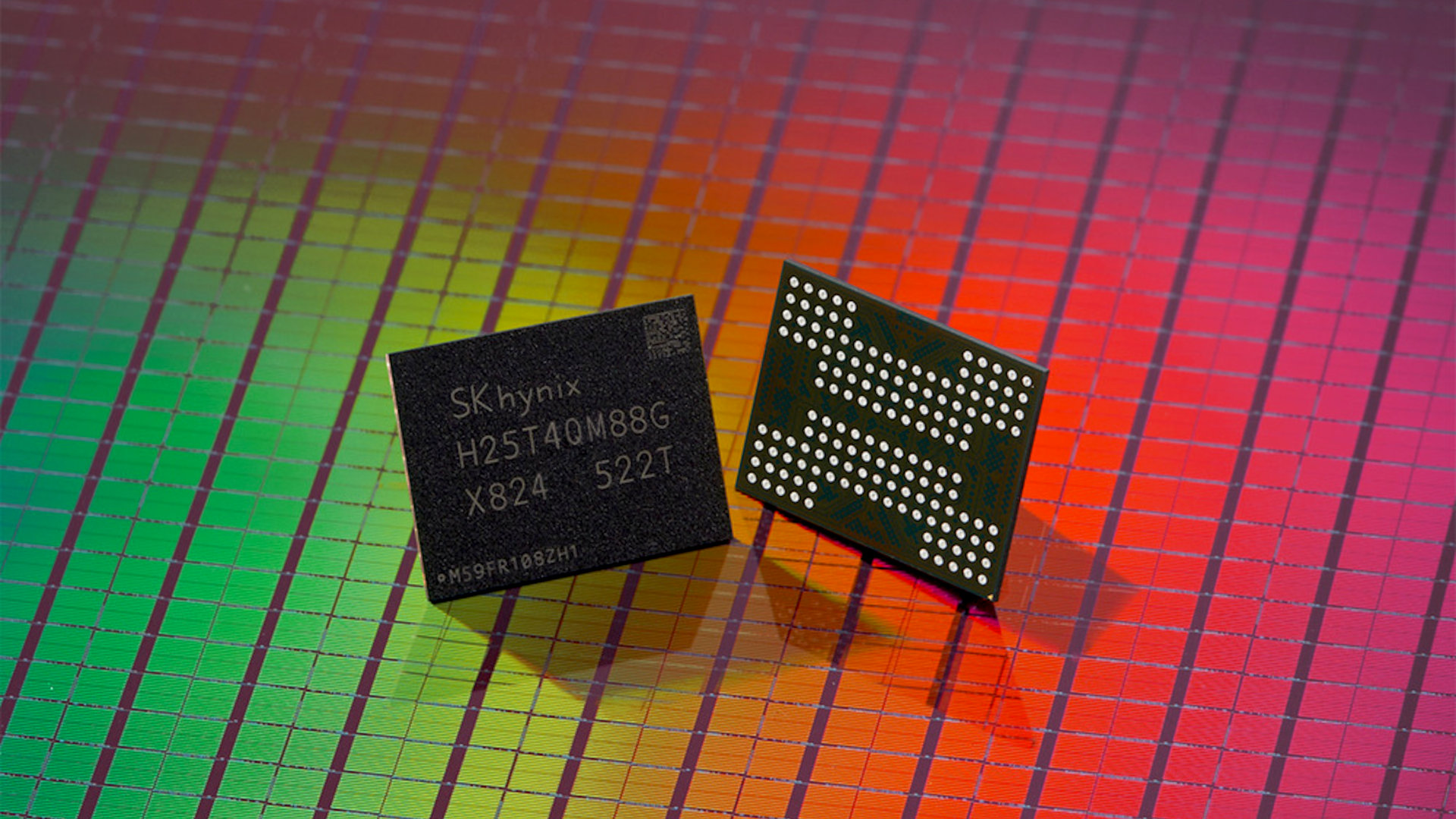

As for NAND flash memory for SSD, SK Hynix says it, "plans to maximize product competitiveness by transitioning to 321-layer technology, while actively addressing AI data center storage demand by leveraging Solidigm’s QLC eSSD."

Yet again, it's AI, AI, AI. Indeed, the final sentiment in SK Hynix's press release covering the financial results pretty much says it all:

“We will strengthen our role not merely as a product supplier, but as a core infrastructure partner in the AI era, enabling customers to meet their AI performance requirements.”

In other words, not a word about consumer computing platforms, including the PC. That really doesn't bode at all well.

Incidentally, if you're wondering what SK Hynix is going to do with all that cash, it also announced a roughly $700 million special dividend for shareholders, which works out to about $1 per share. Add to that the regular quarterly dividend that's also being paid and the year-end payout amounts to $1.45 billion or about $1.30 per share. In a word, kerching!

1. Best gaming laptop: Razer Blade 16

2. Best gaming PC: HP Omen 35L

3. Best handheld gaming PC: Lenovo Legion Go S SteamOS ed.

4. Best mini PC: Minisforum AtomMan G7 PT

5. Best VR headset: Meta Quest 3

Jeremy has been writing about technology and PCs since the 90nm Netburst era (Google it!) and enjoys nothing more than a serious dissertation on the finer points of monitor input lag and overshoot followed by a forensic examination of advanced lithography. Or maybe he just likes machines that go “ping!” He also has a thing for tennis and cars.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.