Cryptocurrency prices tank due to regulatory fears

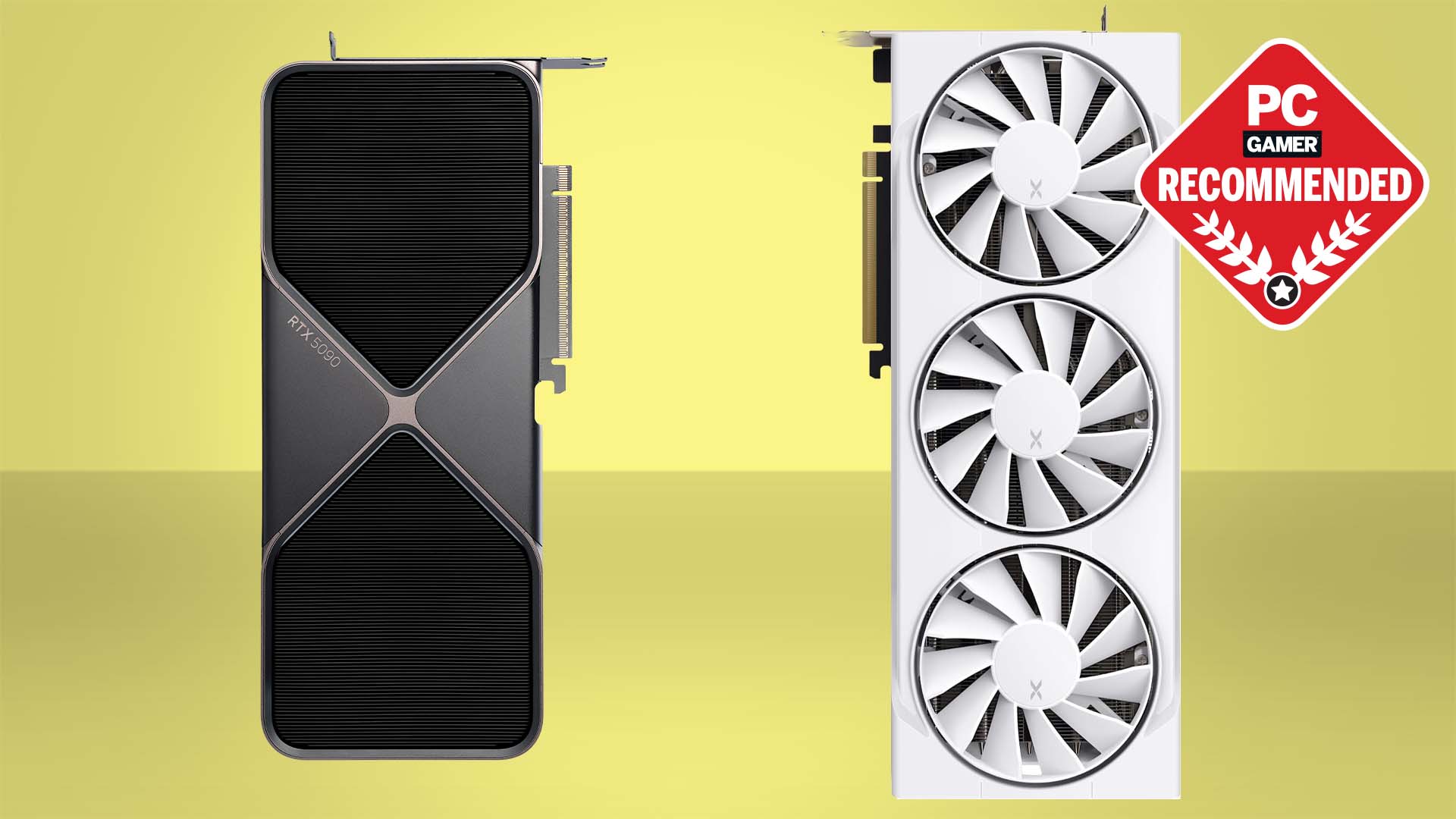

But graphics cards are still going for insane prices.

For cryptocurrency investors, it's been a rocky 24 hours. On Tuesday, reports that China and Russia may enact more regulations around cryptocurrency exchanges sent Bitcoin, Ethereum, and Ripple dropping billions off their market caps. Bitcoin was sitting at around $14,000 before it dropped to below $10,000, though it's climbed back up to more than $11,000 on Wednesday. It's still sitting at nearly 18 percent down since last week, according to Coinbase. It's also been a bad week for PC gamers looking to buy new graphics cards, as the prices are exorbitant thanks to dwindling stock and rampant mining. And unfortunately, crypto's woes are unlikely to lead to more graphics card stock right away.

This isn't the first time Bitcoin and other cryptocurrencies have seen huge swings in value. Just recently, in mid-December, Bitcoin dropped from $19,000 to about $12,600, before climbing back up. This time is likely no different, but the reasons behind it could point to more significant, long-term changes in cryptocurrency prices and trading in 2018.

"With South Korea, Japan and China all making noises about a regulatory swoop, and officials in France and the United States vowing to investigate cryptocurrencies, there are concerns that global coordination on how to regulate them will accelerate. Officials are expected to debate the rise of bitcoin at the upcoming G20 summit in Argentina in March," writes Reuters.

The Guardian offers a bit more detail, saying Chinese state media has reported that the government plans to eliminate cryptocurrency trading, and Russia will likely further regulate cryptocurrency in the future.

Bitcoin is down more than 40 percent since last month, according to Coinbase, while Ethereum, despite dropping more than 11 percent of its value in the past day, is still up more than 27 percent since December. If you're following or investing in cryptocurrency, expect things to remain just as volatile as they are now—and expect hardware prices and availability to lag behind. Until hardware companies start pumping out higher quantities of graphics cards, or regulations manifest in more permanent changes to crypto valuations, expect graphics cards to remain precious commodities.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

Wes has been covering games and hardware for more than 10 years, first at tech sites like The Wirecutter and Tested before joining the PC Gamer team in 2014. Wes plays a little bit of everything, but he'll always jump at the chance to cover emulation and Japanese games.

When he's not obsessively optimizing and re-optimizing a tangle of conveyor belts in Satisfactory (it's really becoming a problem), he's probably playing a 20-year-old Final Fantasy or some opaque ASCII roguelike. With a focus on writing and editing features, he seeks out personal stories and in-depth histories from the corners of PC gaming and its niche communities. 50% pizza by volume (deep dish, to be specific).