RX Vega's inventory problems aren't due to cryptocurrency miners

Limited supply at launch is normal, and there are better options for mining.

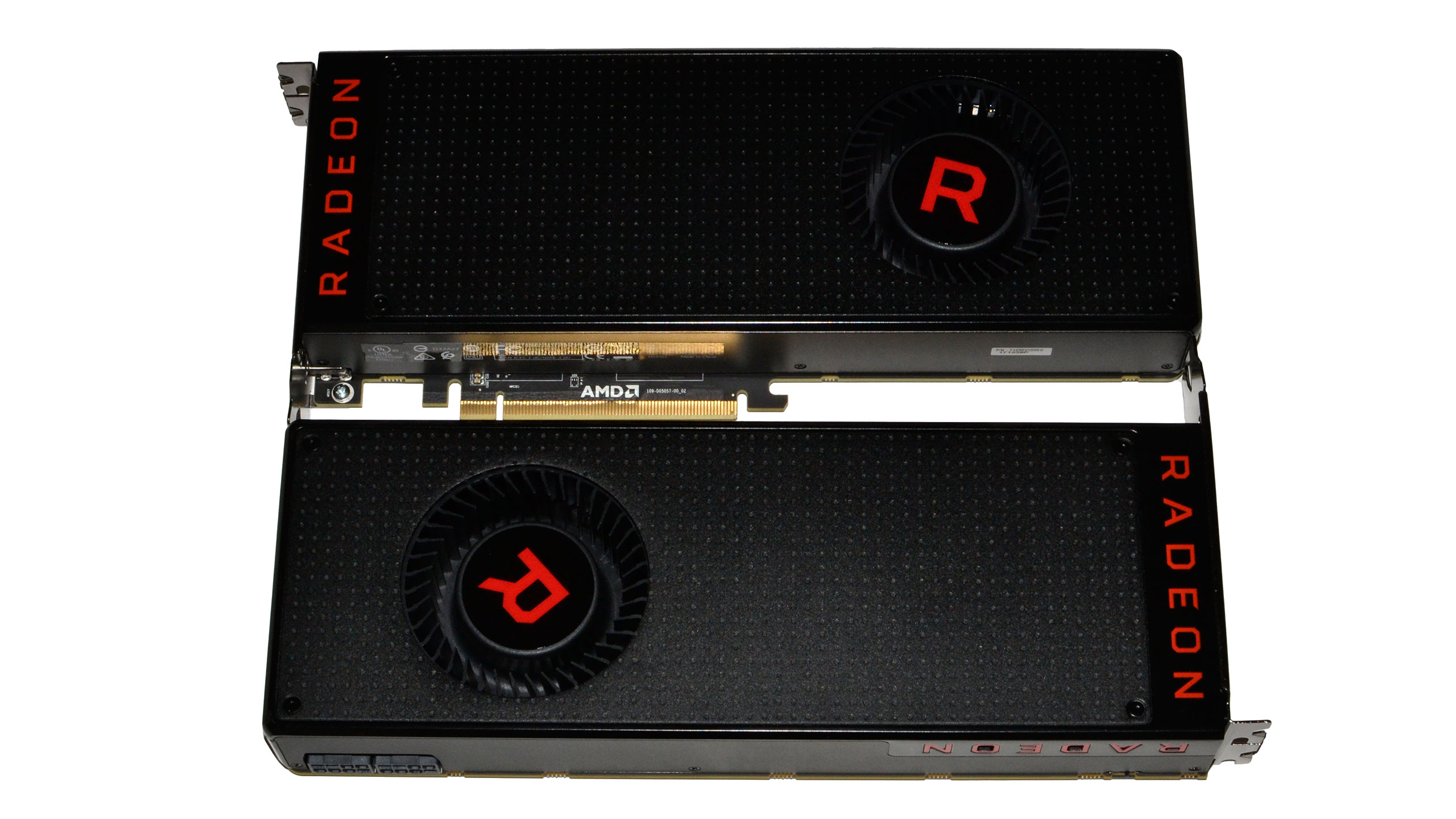

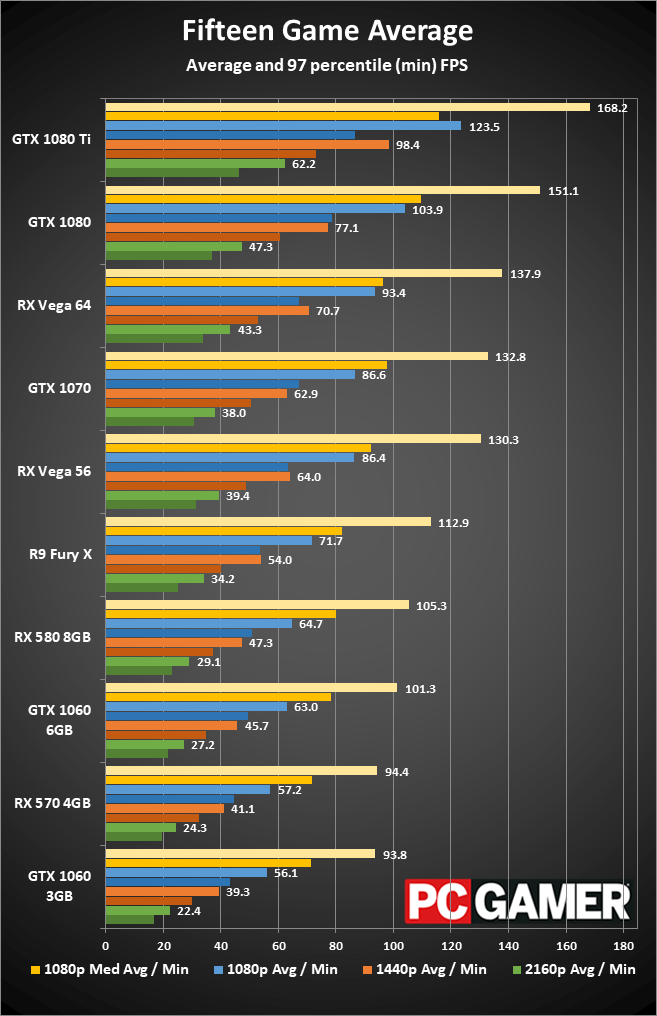

Yesterday, AMD's long-awaited Vega architecture finally arrived in the form of the RX Vega 64, with the RX Vega 56 slated to arrive on August 28. Performance is good, though in my testing it still falls behind the GTX 1080 Founders Edition. Pricing is a bit of a mess, however, with the standalone RX Vega 64 basically MIA right now—I saw a $500 card at Newegg yesterday morning, but it has since disappeared. Not that it really matters, because all of the Vega 64 cards are currently out of stock. Some would say AMD (or at least the retail outlets) are intentionally hiking the price by $100, but this is all business as usual, particularly for a highly anticipated high-end graphics card.

Last summer, when the GTX 1080 and GTX 1070 launched, it was virtually impossible to find those cards at anything close to MSRP for a couple months. And that was even including the higher prices of the initial Founders Edition cards. Many other graphics cards are currently out of stock or selling at highly inflated prices, however, thanks to the upsurge in cryptocurrency mining. The Radeon RX 570 and Radeon RX 580 continue to sell at more than $100 over their initial launch prices (in some cases nearly twice the MSRP), GeForce GTX 1070 is way above its official $379 MSRP, and GTX 1060 6GB cards are also overpriced. All of this is thanks (or no-thanks) to miners. Into this high demand, limited supply graphics card market, AMD has launched Vega, which went out of stock almost immediately. Many are keen to point the finger at miners once again, the source of all our gaming woes.

Here's the reality check: despite rumors and claims of Vega doing 70-100 MH/s (in Ethereum), in practice it's far less impressive right now. Using Claymore's version 9.8 miner, at stock I measured around 31MH/s on the Vega 56 and 33MH/s on the Vega 64 (I've seen a few claims of 35MH/s for Vega 64 at stock). That compares to typical performance of existing GPUs, using the same software, of 24MH/s for the RX 570 4GB, 27MH/s on RX 580 8GB, 21MH/s for GTX 1060 6GB, and 29MH/s on GTX 1070. Higher is better, so that means Vega is the best solution now, right? Not so fast...

Mining isn't just about raw mining performance, but also the power requirements and cost of the hardware. Most professional GPU mining is done on rigs with six graphics cards each, to maximize profits—because you have to pay for the rest of the PC parts as well. Cost of power and is power use are also factors, the latter of which requires a bigger (more expensive) PSU, or at least multiple smaller PSUs. Putting six 1060 6GB cards in a rig with a good 800-1000W PSU isn't a problem, and six 1070 or RX 570/580 cards in a rig with a 1000-1200W PSU would also work. But when Vega 64 can draw around 275W of power per card, you'd be looking at 2000W PSUs, or five GPUs with a 1500W PSU, or a pair of 1000W PSUs.

In other words, it simply becomes more economical to run additional PCs using less power-hungry GPUs. Even if the Vega 64 were readily available right now for $500, that's $3,000 in GPUs, plus another $800 in the remainder of the PC, for a rig that could do perhaps 210MH/s and use 1650W. That's better hashing performance than 170MH/s with six 1070 cards, but the 1070 rig would only use around 900W. Using the current going rate of $283 for Ethereum, that's around $14 per day in gross profits from Vega 64, minus $4 in power costs ($0.10 per kWh), versus $11.50 gross and power costs of $2.20. The Vega rig would still be more profitable at approximately $10 per day vs. $9.30 per day, but even at the inflated $450 pricing of GTX 1070, going with Nvidia would be the better buy—$3,300 total for the mining rig compared to $3,800 with Vega cards. At $0.70 per day in additional profit, it would take about two years before the Vega rig would come out ahead. (Assuming current pricing and difficulty trends remain the same, which of course they won't.)

But we can take that a step further. Six GTX 1060 3GB cards, the cards that seem strangely neglected, will do around 120MH/s, and you can buy those cards for $210 each (or $230 each at Amazon/Newegg). You'd only need a good quality 750W PSU, which means the total mining rig cost would be $1,700 (or $1,800 with the more expensive 1060 cards). You'd be able to earn around $8.20 gross, and $6.90 net. Build two of those for less than the price of a single Vega rig and you'd have a higher total hashrate and better profitability.

What does this mean for Vega 64 and mining? Realistically, it would need to do at least 40MH/s and preferably 45MH/s in Ethash before it becomes a good graphics card for mining. That could still happen, with firmware updates, new drivers, and/or optimized mining software, but it remains a future potential rather than a current factor. Apparently the way HBM/HBM2 currently works, it's not optimal for random access and this limits mining performance. It's possible that updated firmware could improve the situation, but that remains a future possibility rather than something currently implemented. Even then, other factors can make the RX 570/580 or GTX 1060/1070 more attractive overall.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

Which is a long-winded way of saying that RX Vega 64 cards are more likely out of stock because plenty of gamers were interested in buying an AMD Vega card. I'm sure some miners bought them as well, in hopes of new mining software offering substantially higher hashrates (perhaps for other hashing algorithms like Equihash), but initial supply of Vega cards was never going to satisfy the market demand, with or without miners.

All of this comes at the same time that Bitcoin broke the $4,000 mark for the first time in its history, and while that might seem unrelated to Ethereum mining, the higher price of Bitcoin tends to carry over to many other cryptocurrencies. Long-term, I also don't expect to see blockchain currencies disappear, something echoed by both AMD and Nvidia CEOs. Jensen Huang recently stated in an Nvidia earnings call, " Cryptocurrency and blockchain are here to stay. The market need for it is going to grow, and over time, it will become quite large." He goes on to say that the GPU is fantastic at cryptography, it's a market not likely to go away soon, and that Nvidia plans to offer miners a SKU that's optimized for mining. AMD's Lisa Su has also recognized the influence of coin miners, when she noted the "elevated demand for cryptocurrency" and the lean stock of AMD GPUs during an analyst call.

The good news is that with increased demand from all corners for GPUs—whether they're used for graphics, machine learning, cryptocurrency, or other tasks—we can expect performance to continue to increase, and prices should drop over time as well. We're currently in a small blip of constrained supply and elevated demand, but these things eventually get sorted out. Miners may be gobbling up GPUs right now, but the profit from those sales will eventually feed into better graphics cards for gamers.

Jarred's love of computers dates back to the dark ages when his dad brought home a DOS 2.3 PC and he left his C-64 behind. He eventually built his first custom PC in 1990 with a 286 12MHz, only to discover it was already woefully outdated when Wing Commander was released a few months later. He holds a BS in Computer Science from Brigham Young University and has been working as a tech journalist since 2004, writing for AnandTech, Maximum PC, and PC Gamer. From the first S3 Virge '3D decelerators' to today's GPUs, Jarred keeps up with all the latest graphics trends and is the one to ask about game performance.