Cryptocurrency ICOs have a spectacularly high failure rate

Around half of last year's cryptocurrency ICOs are already dead.

Last week we speculated what the fallout of a cryptocurrency collapse might mean for graphics cards and how it might affect AMD and Nvidia. In the days since posting that article, a report emerged highlighting how many of last year's cryptocurrency ICOs are now dead, and it turns out there is a lot of them.

An "ICO," or initial coin offering, is when a startup raises funds for its new cryptocurrency by selling tokens of its digital coin in exchange for legal tender or other cryptocurrencies, usually Bitcoin. There are not a lot of regulations in place, which makes these ICOs even riskier.

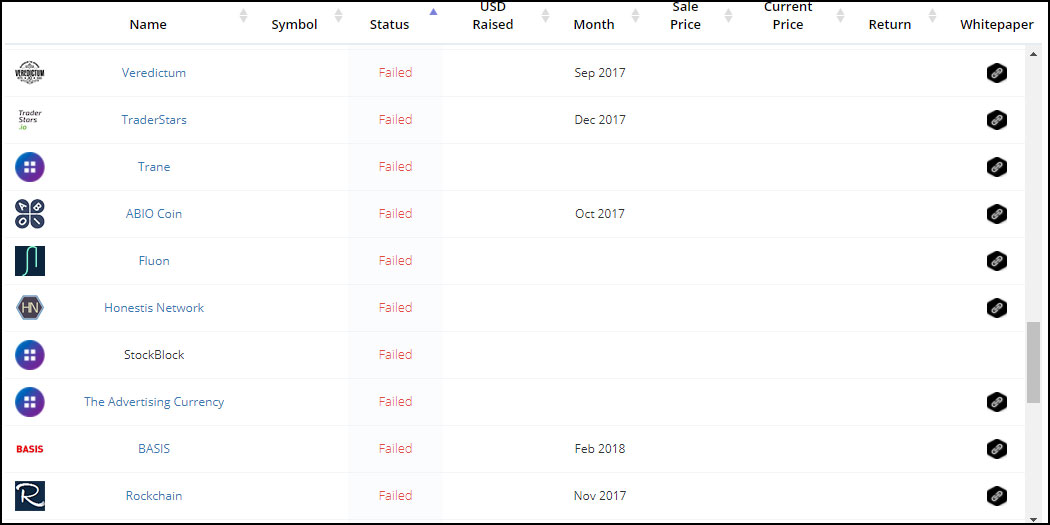

To see exactly how risky, Bitcoin.com took a look at last year's ICOs as tracked by TokenData. What it found is that of the 902 cryptocurrency ICOs formed in 2017, 142 failed before raising any funds, and 276 failed after fundraising. Those figures combined work out to a 46 percent failure rate, despite raising over $104 million.

On top of that, another 113 ICOs fall under the "semi-failed" category, either because the respective startup ceased communicating on social media, or the community dwindled to the point where it has virtually no chance of success. Toss those figures into the pile and the failure rate rises to 59 percent.

"Trawling through 900 ICOs in one sitting is a deeply depressing experience, news.Bitcoin.com can report. Abandoned Twitter accounts, empty Telegram groups, websites no longer hosted, and communities no longer tended are par for the course. A digital graveyard, complete with metaphorical tumbleweed, characterizes the crop of 2017 that decided to take the money and run," Bitcoin.com says.

The figures might not be 100 percent accurate, as one of the seemingly doomed ICOs, Neverdie, reached out to Bitcoin.com to clarify that it's still kicking. But even accounting for a few misses, the failure rate is high, though not really surprising.

Earlier this month, an analyst with Goldman Sachs predicted that most cryptocurrencies will plummet to a zero valuation.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

"Whether any of today’s cryptocurrencies will survive over the long run seems unlikely to me, although parts of them may evolve and survive," Goldman Sachs analyst Steve Strongin said. "Because of the lack of intrinsic value, the currencies that don’t survive will most likely trade to zero."

According to Strongin, not even being one of the first affords any advantage. He points out that very few companies from the internet bubble of the late 1990s went on to become more valuable.

"Amazon did—but in a completely different form. Google—a big winner today—had only just been formed at the time," Strongin said.

Put another way, Bitcoin, Ethereum, and any number of existing cryptocurrencies are not likely to survive beyond the bubble, assuming there is one.

Paul has been playing PC games and raking his knuckles on computer hardware since the Commodore 64. He does not have any tattoos, but thinks it would be cool to get one that reads LOAD"*",8,1. In his off time, he rides motorcycles and wrestles alligators (only one of those is true).