Samsung and SK Hynix, the world's biggest makers of DRAM and flash memory chips, have potentially lost the right to buy US equipment for use in their China-based factories

It's not a big problem at the moment, but don't be surprised if, at the end of it all, you'll just be paying more for your PC parts.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Whether it's your graphics card, RAM sticks, or SSD, they all contain memory chips that have probably been manufactured by one of two companies: Samsung and SK Hynix. While the majority of their production takes place in their native South Korea, both firms have lots of plants in China. And due to a recent decision by the US government, they will no longer be able to automatically purchase US equipment for use in those factories.

It was Reuters that first reported on the matter, noting that the move has already resulted in a small but significant drop in share prices. Samsung and SK Hynix are the world's largest manufacturers of DRAM and NAND flash memory chips, with US firm Micron some way behind in third place.

Just as with CPUs and GPUs, the fabrication of memory chips requires huge, complex machinery and no small amount of this is made in the US. Up until now, both South Korean firms have been able to directly purchase such apparatus from American companies and use it in any of their plants.

This was part of an exemption deal set up in 2022, giving them a Validated End User status, but that's all over. Now, Samsung, SK Hynix, and other semiconductor firms will need to apply for licences to import US chip technology and equipment. Reuters reports that the US Commerce Department "plans to grant license applications to allow the companies to operate their existing facilities in China, but does not intend to grant licenses to expand capacity or upgrade technology."

It's not clear precisely how much of Samsung and SK Hynix's memory production is based in China, but the former manufactures all of its DRAM in South Korea, whereas the latter is estimated to have more than a third of its memory output from China. With the import restriction said to start within the next 120 days, there won't be any immediate impact on factory output, though.

It's safe to assume that both companies will immediately apply for the aforementioned licences, and I should imagine that they will be granted, given how much of the computing and phone industry relies on their products. However, the long-term impact may be a different thing entirely.

With no means to easily upgrade their China-based factories, Samsung and SK Hynix could lose ground to Micron (possibly an intentional outcome, given that it's a US company) but also to Chinese DRAM and flash manufacturers, such as Yangtze Memory Technologies Company (YMTC), whose chips are used by Lexar for their SSDs.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

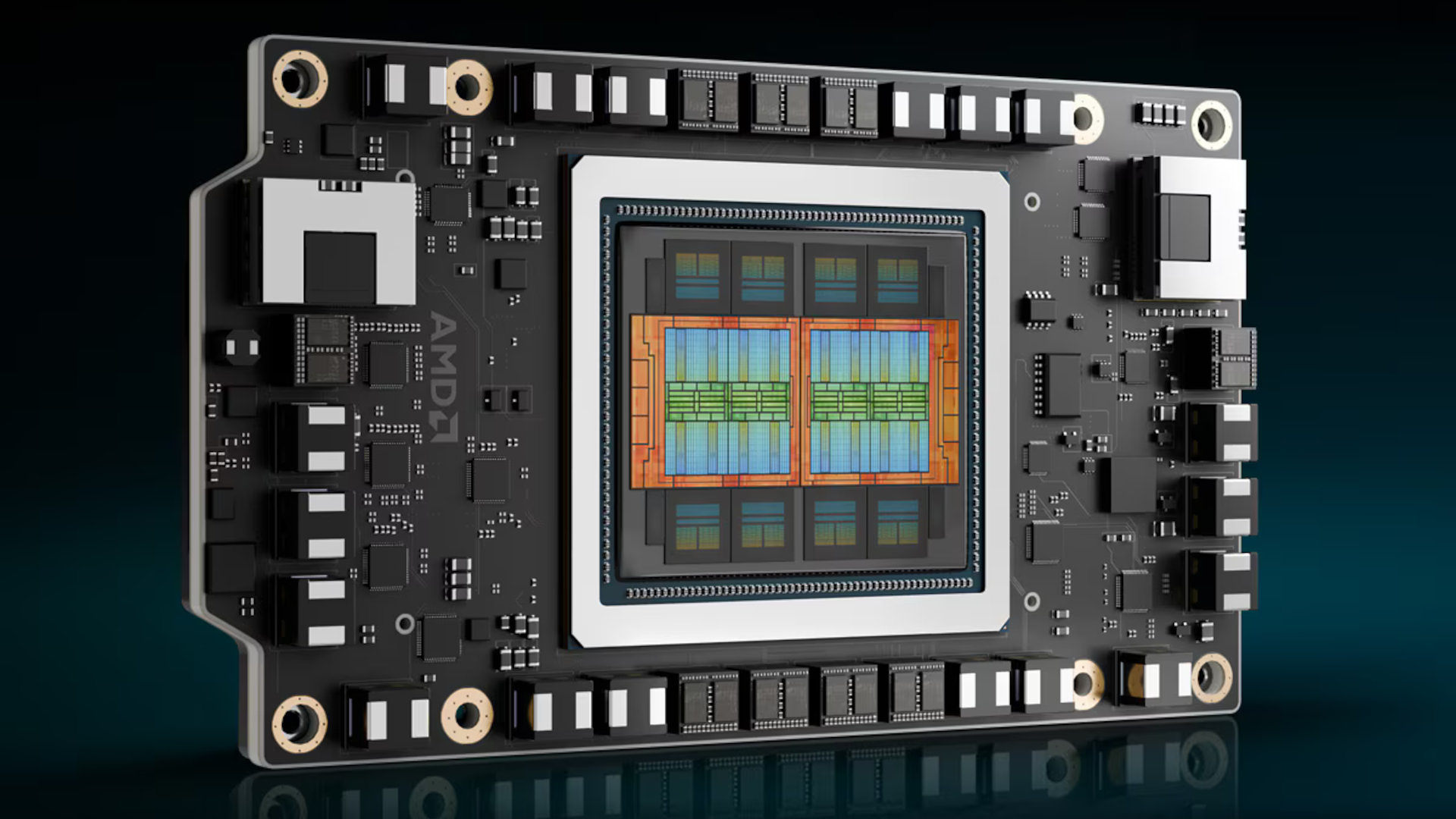

Perhaps not, though, because of AI. The insatiable demand for massive processors from AMD and Nvidia has been a boon for Samsung and SK Hynix, because they manufacture the special HBM (High Bandwidth Memory) chips that are required for the likes of Nvidia's GB200 and AMD's MI355X.

Such is the demand for HBM right now that the South Korean firms decided that it wasn't worth churning out DDR4 RAM, and initially targeted the end of 2025, or early 2026, to stop all production. However, this move caused DDR4 prices to increase significantly, and there are now reports that both firms are considering extending their manufacturing to keep the RAM cash flowing.

Anyway, while it's likely that all HBM production is done in South Korea, as it requires the very best equipment and processes that Samsung and SK Hynix have, there are no signs that the demand for AI chips will tail off any time soon. If anything, the opposite is true, and the memory chip giants may be forced to improve their factories in China to keep up with orders.

While the US Commerce Department is saying that it doesn't intend to grant licences for this to happen, I wouldn't be surprised if some kind of deal is made whereby Samsung and SK Hynix can purchase American semiconductor equipment for any use in China, but with an appropriate tariff applied.

None of this should impact RAM and flash memory prices just yet, but if the waters don't settle, then eventually the end of the whole chain—you and me—will invariably be forced to pay more for our graphics cards, memory sticks, and SSDs. Yes, Nvidia uses Micron chips for almost all of its GPUs, but you can bet your last penny that if Samsung and SK Hynix stuff goes up in price, so will everything else.

👉Check out our list of guides👈

1. Best CPU: AMD Ryzen 7 9800X3D

2. Best motherboard: MSI MAG X870 Tomahawk WiFi

3. Best RAM: G.Skill Trident Z5 RGB 32 GB DDR5-7200

4. Best SSD: WD_Black SN7100

5. Best graphics card: AMD Radeon RX 9070

Nick, gaming, and computers all first met in the early 1980s. After leaving university, he became a physics and IT teacher and started writing about tech in the late 1990s. That resulted in him working with MadOnion to write the help files for 3DMark and PCMark. After a short stint working at Beyond3D.com, Nick joined Futuremark (MadOnion rebranded) full-time, as editor-in-chief for its PC gaming section, YouGamers. After the site shutdown, he became an engineering and computing lecturer for many years, but missed the writing bug. Cue four years at TechSpot.com covering everything and anything to do with tech and PCs. He freely admits to being far too obsessed with GPUs and open-world grindy RPGs, but who isn't these days?

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.