Report: Overall market for PC memory has 'entered freefall'

Good news for consumers.

Trying to get a pulse on the historically volatile memory market is no easy task, though more recently, prices have trended downwards. That could continue to happen, following the sharpest decline since 2011 last quarter, according to DRAMeXchange, a division of TrendForce.

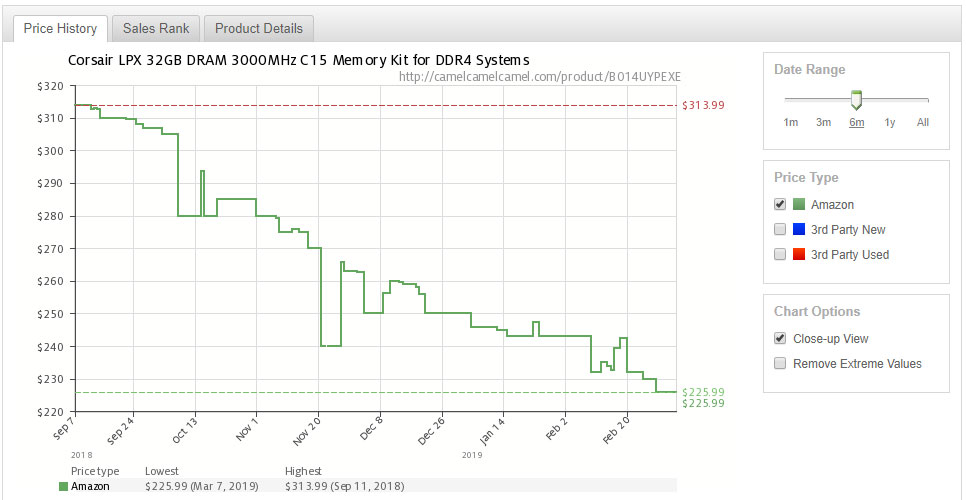

I've pointed to these types of reports on multiple occasions in the past, and we're seeing the price drops play out in the marketplace. Just yesterday, for example, Benjamin called attention to a discount on a 32GB kit of Corsair Vengeance LPX DDR4-3000 memory. While not cheap at $225.99, it's 44 percent below its list price.

Equally interesting is how the price of that particular kit has fallen over the past several months, as tracked by CamelCamelCamel. Have a look:

According to DRAMeXchange, contract pricing for DRAM fell a staggering 30 percent last quarter, surpassing the 25 percent decline the research firm had projected.

Looking ahead, the research firm notes that inventory levels have continue to climb since the last quarter, despite the steep drop off in contract prices. DRAMeXchange estimates that most DRAM makers are sitting on a "whopping six weeks' worth of inventory" at this point.

Compounding the situation is that Intel is still dealing with a shortage of lower end CPUs, which is expected to be the case through the third quarter of this year, according to the report.

"PC-OEMs are unable to carry out the consumption of DRAM chips under demand suppression. The overall market has thus entered freefall, meaning that large reductions in prices aren't going to be effective in driving sales. The excessively high inventory will continue to cause down-corrections in prices this year if demand doesn't make a strong comeback," DRAMeXchange says.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

If you're shopping around for the best DDR4 RAM for your system, keep your eyes peeled for discounts and general price drops. There are bargains to be had, and barring a change in circumstance, that should be true for most of the year.

Being a volatile market, though, things could change at any given moment. As it relates to that, Digitimes reports separately that the server market could be the tourniquet that DRAM makers need to stop the bleeding.

"The DRAM market will remain in an oversupply situation through the first half of second-quarter 2019 ... Nevertheless, demand for servers is expected to start picking up between the end of the second quarter and the third quarter, which may also start lifting DRAM prices," Digitimes says, based on what it was told by its sources.

Take from that what you will. While nothing is guaranteed, it seems likely that prices will continue to fall for at least the next several months before potentially leveling out or even rising again.

Paul has been playing PC games and raking his knuckles on computer hardware since the Commodore 64. He does not have any tattoos, but thinks it would be cool to get one that reads LOAD"*",8,1. In his off time, he rides motorcycles and wrestles alligators (only one of those is true).