Report says cryptocurrency demand drove annual graphics card shipments up 66 percent, optimistic about availability

Jon Peddie Research believes the graphics card market for cryptocurrency mining is now saturated.

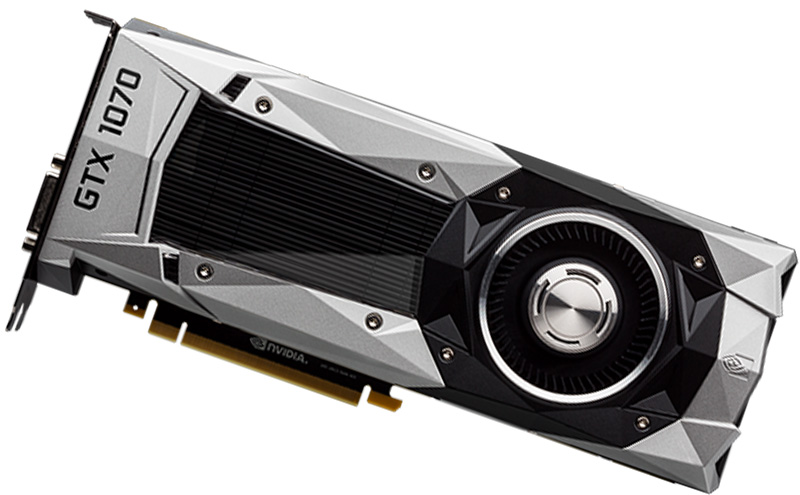

For many months, gamers in need of a GPU upgrade found themselves in a tough spot. Finding a mid-range or high-end graphics card in stock was a challenge in and of itself, and most of the time they were selling for way above MSRP. Things have finally settled down, but will there be another shortage? Perhaps not in the near future, if a new report by Jon Peddie Research is correct in its assessment.

One of the reasons why graphics cards were tough to come by is because, in some cases, cryptocurrency miners were buying them by the plane load. It's not entirely clear how much that actually played a role versus memory makers allocating more of their production lines to NAND flash chips at the expense of DRAM, but it was at least partly responsible.

JPR notes as much in its latest report, saying that cryptocurrency mining is "continuing to influence the PC graphics market." However, the report also states that "its influence is waning."

"We believe the market for crypto-mining AIBs (add-in boards) has saturated and the miners who wanted AIBs have got them now. The gamers, who have pulled back on purchases due to surge-pricing by the channel, are now seeing supply increase and prices coming back down. We think there is pent-up demand among gamers, which will carry forth into Q2 and will help mitigate the usual seasonal decline in the second quarter for desktop discrete GPU sales," JPR says.

That's good news for games, if the forecast holds true. There's no guarantee it will, of course, especially given the volatile nature of cryptocurrency—a spike in value could set off another mining boom. However, even Nvidia recently said it expects crypto sales to drop off by around two-thirds in the current quarter.

"Crypto miners bought a lot of our GPUs in the quarter and it drove prices up, Nvidia CEO said on a conference call. "I think that a lot of gamers weren’t able to buy into the new GeForce as a result."

JPR's numbers point to that being the case as well. Even though gamers had a tough time finding graphics cards this past year, JPR says discrete desktop GPUs saw an annualy shipment growth rate of 66.4 percent, and a 6.4 percent quarterly growth rate. So, those GPUs were going somewhere.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

As a whole, JPR says cryptocurrency miners bought three million graphics cards worth $776 million in 2017, and another 1.7 million in the first quarter of 2018.

Nvidia seems to have benefited the most, with its share of the GPU market rising from 15.8 percent to 18.4 percent year-over-year, versus AMD bumping up from 13.1 percent to 14.9 percent. Intel still holds the largest share at 66.6 percent (down from 71.1 percent) because most of its CPUs have integrated graphics.

Looking ahead, it's rumored Nvidia will launch its next generation GeForce GTX 1180 (or 2080) in July. Here's hoping there will be enough cards to go around.

Paul has been playing PC games and raking his knuckles on computer hardware since the Commodore 64. He does not have any tattoos, but thinks it would be cool to get one that reads LOAD"*",8,1. In his off time, he rides motorcycles and wrestles alligators (only one of those is true).