PC sales down, but high end graphics holds steady

With summer already approaching its end, it's Q2 reporting season already and time for naysayers of the world to unite around statistics. We've seen a few quarterly snapshots which have made glum reading for PC fans already.

Gartner's analysis, for example, that PC shipments in Western Europe were down by nearly 19% was bleak indeed. Acer was especially badly hit, losing over a third of its sales compared to last year.

No-one, it seems, is buying anything but iPads. Which is one of the reasons HP spectacularly announced last week that it is selling off its PC business altogether . That's the world's number one PC vendor leaving us to focus on cloud stuff. Ouch.

Despite what Razer might have you believe , though, things are actually looking quite good as far as PC gaming hardware goes. Jon Peddie Research – one of the few analyst firms that track sales of graphics cards – published its quarterly report yesterday. In this, it showed that shipments of graphics cards were below slightly below average for the last three months.

However, it included this interesting qualifier:

“The add-in board (AIB) market is fuelled at the high-end by the enthusiast gamer, small in volume (~3m a year) but high in dollars (average spend for an AIB ~$300). The AIB shipment volume comes from the Performance and Mainstream segments. GPU-compute is adding to sales on the high end.”

That's a figure which surprised me, and pleasantly so. If high performance GPUs are still near enough to a billion dollar market, that's big enough to keep the big graphics companies interested for some time to come. To check I wasn't viewing this through the proverbial rose tinted contacts, I mailed Dr Jon Peddie and asked him to clarify his thoughts.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

“The remarkable thing about the AIB market,” he explained, “Is that the high-end enthusiast segment is the most stable. The other segments move up and down and the enthusiast is relatively (he said 'relatively') stable.”

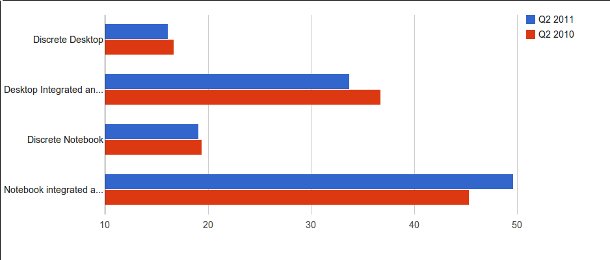

Delving a bit deeper into the figures from his latest report, the big hit on GPU sales has been for low performance cards. Discrete desktop graphics (all types) are down by just 500,000, from 16.67m last year to 16.12 for the same period this year, while discrete notebook graphics are down by 300,000 to 19.06m.

All of which is to say that yes, there are profound and fundamental shifts happening in the way we use PCs and computers in general. There'll be more big names go the way of HP before too long, no doubt.

But as far as high performance gaming set-ups go, in this analysis at least, they're looking just as popular as ever. And don't let anyone tell you otherwise.