What Nvidia buying Arm means for PC gaming

All you need to know about Nvidia's purchase of UK chip designer Arm for $40bn, and what happens next.

With clients spanning nearly every major technology company, and 180 billion chips shipped to-date, Arm is one of the most important semiconductor design companies in the world. It already licenses its technology out to Nvidia, but also to Apple, Qualcomm, and many more, and is used in nearly every smartphone, smart device, and TV. Today, as Nvidia announces its deal to purchase Arm (often listed as ARM or arm, for various reasons) for $40bn, the company's future is more interesting than ever.

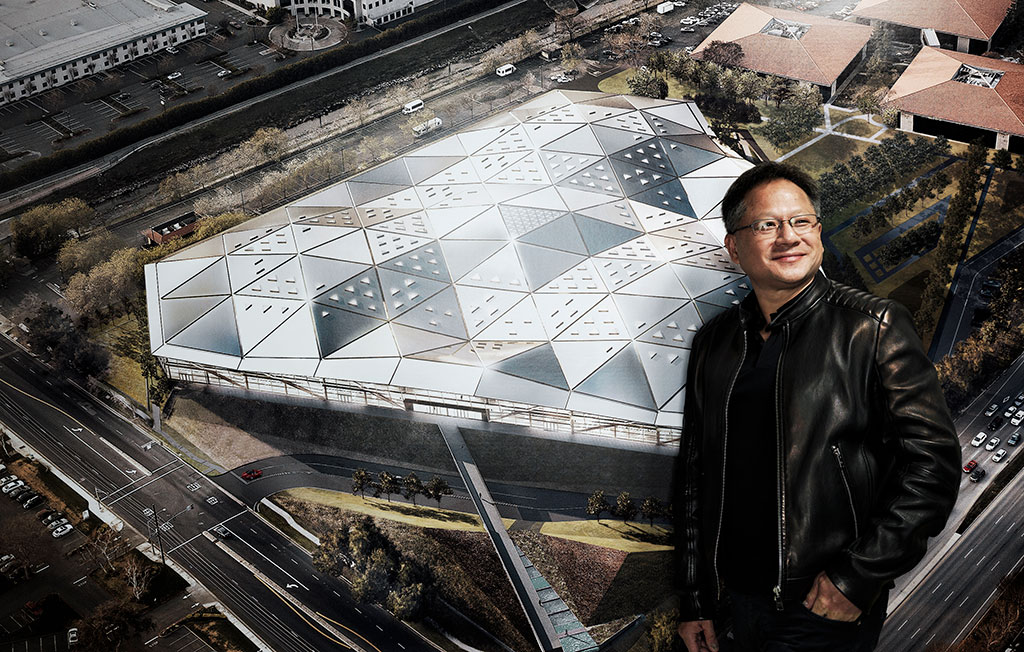

At $40bn, Nvidia's acquisition of Arm will be the company's largest to date. Nvidia's past purchases include 3dfx, AGEIA, and, most notably, Mellanox Technologies, a datacentre networking technology company for $6.9bn, at the time its largest purchase by some margin. The Arm deal easily surpasses that figure, and is evident of not only Nvidia's looser purse strings but also its incredible value.

Nvidia recently surged to become more valuable than Intel, and is now worth $326bn. Intel, on the other hand, has not hit that $300bn market cap (the sum of all outstanding shares at current value) for some time, and currently sits at $210bn. It's a significant achievement for CEO and founder Jen-Hsun Huang's company, and perhaps goes some way to explaining why it can afford a purchase as lavish as Arm, the gem in the so-called Silicon Fen's (the cluster of tech businesses surrounding Cambridge, UK) crown.

What is Arm and what does it do?

Arm is a British semiconductor and software design company. That means that, while some companies manufacture chips, such as Intel or TSMC, which also have foundries (known commonly as fabs), Arm does not. It's like AMD or Nvidia in the fact that it designs its chips for another company to actually build, but unlike AMD and Nvidia it does not sell them directly in a way us gamers would be familiar with. Instead, Arm licenses out its intellectual property (IP) for a fee to other companies for use in their products.

Hence why a company like Apple can claim to be henceforth designing its own processors for use in its laptops and phones, all the while relying on Arm architectures. Apple pays Arm for an architectural license, in this case 64-bit ARM, and builds out its own secretive chip from there.

Arm does also work on its own technologies, for a sort-of direct sale. However, these are most often semi-custom designs that make use of Arm's IP, such as the Armv8-A Architecture, in a standardised CPU design, such as the Cortex A78. The brunt of actually manufacturing and selling these products still falls on whoever is licensing the chip.

As part of Nvidia, Arm will continue to operate its open-licensing model, while maintaining the global customer neutrality that has been foundational to its success

Nvidia

What Arm is able to offer companies is a way to ensure compatibility across a wide range of devices and systems, with a constant instruction set, all without having to own that ecosystem outright. This is in direct contrast to Intel and the x86 instruction set (who licenses it to very few others, namely AMD), and who then also has complete control over the ecosystem and who can use it.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

Another such instruction set architecture (ISA) is RISC-V (pronounced risk-five, and standing for Reduced Instruction Set Computing), which is an open-source license for all to use. Occupying some of the same space as ARM (also a RISC architecture) RISC-V also attempts to do away with closed ecosystems to an even greater extent—but that's a story for another day.

And for those of you wondering: arm or Arm tends to denote the semiconductor design company, while ARM tends to stand for the ISA or IP itself. Most of the time. Sometimes.

Why was Arm up for grabs?

Arm Ltd. was founded in 1990, and while it has maintained autonomy for the better part of that period, in 2016 a sale was agreed between Arm's shareholders and Japanese super-holding company Softbank for the grand total of $32bn.

Softbank's purchase of the company was record-breaking at the time—it was one of the largest for the UK, Japan, and the chip making business as a whole.

Softbank also has a history with Nvidia, although not an altogether happy one. It was, at one time, one of Nvidia's largest shareholders with some $3.6bn in shares (relative to Nvidia's January 2019 share price, which was then around ~$150). These were a part of Softbank's grand $100bn technology Vision Fund.

Following the cryptocurrency crash, which saw Nvidia inadvertently flood the market with its own Pascal 10-series graphics cards, losing a heap of crypto-income in the process, and lose lost nearly half of its value—Softbank then sold off its entire stake.

The Nvidia Ampere generation is nearly upon us—here's everything you need to know about the RTX 3090, RTX 3080, and RTX 3070.

That quarter, by Nvidia's own admission, was "a real punch in the gut". Yet it wasn't to remain in the dumps for long, and by the summer it had already started to gain value. By February 2020, Nvidia had regained all of the value it initially lost from that cryptocurrency crash, and it now sits at easily double that once again at around $514.

On the other hand, Arm had hardly grown in value during that same period. Despite continued success serving chip designs, Softbank was reportedly looking to sell its majority stake in Arm—from $32bn in 2016, it would find a suitor in Nvidia for just $40bn. Just $2bn in growth for every year it was under Softbank's control.

Putting that into perspective, in 2016 Nvidia was valued, at its peak, at around $50bn, which is not that dissimilar to Arm's value when it was first purchased by Softbank. Now Nvidia is worth over $300bn and is purchasing Arm for just $40bn.

Softbank will retain just under a 10 percent stake in Arm following the closure of the deal, which is expected to go through one year from now, in September 2021.

Note the italicisation of just in reference to these billion dollar sums—it's important to recognise the ludicrous and engorged quantities of cash in discussion here.

What does Nvidia gain by purchasing Arm?

Nvidia licenses Arm for many of its products, most notably its system-on-chip (SoC) platforms from which it builds Tegra systems, such as those found in some self-driving cars and the Nintendo Switch.

An astounding 180 billion computers have been built with Arm — 22 billion last year alone. Arm has become the most popular CPU in the world

Jen-Hsun Huang, Nvidia CEO

But perhaps autonomy for a handful of use-cases is not the endgame for Nvidia's recent acquisition at all. No, it's more likely a consolidation of Nvidia's ability to offer the complete stack for a wide range of uses. It now offers GPUs, networking, and potentially CPUs—Jen-Hsun Huang holds all the cards and would then be almost beholden to no-one.

Huang's vision is to create the "world's premier computing company for the age of AI". It will do so by incorporating its own technology with Arm's to develop new AI technologies, including a new AI research centre in Cambridge, fit with "state-of-the-art AI supercomputer powered by Arm CPUs."

It's not quite vertical integration for Nvidia—that is to say it owns the entire supply chain. But with Intel struggling with its own supply chain and manufacturing, fabless companies, such as Nvidia, appear to be thriving by comparison.

What does Arm's future look like under Nvidia?

One big question surrounding Nvidia's purchase of Arm, and one which wasn't present with Softbank's ownership, is whether Nvidia can continue to license Arm technology fairly and equally. Arm is successful due to its ability to license to anyone, and those licensees can be confident they're not getting the short end of the stick. With Nvidia at the helm, many of the GPU makers rivals will be wondering if Arm's impartiality and independence is as a safe bet as it once was.

To try and ease concerns, Nvidia's own statement on its purchase of Arm outlines its plans to maintain customer neutrality.

Best CPU for gaming: the top chips from Intel and AMD

Best graphics card: your perfect pixel-pusher awaits

Best SSD for gaming: get into the game ahead of the rest

"As part of Nvidia, Arm will continue to operate its open-licensing model, while maintaining the global customer neutrality that has been foundational to its success, with 180 billion chips shipped to-date by its licensees. Arm partners will also benefit from both companies’ offerings, including Nvidia’s numerous innovations."

The debate on customer neutrality will likely continue for some time too. Nvidia and Arm's deal has to be approved by the UK, China, the European Union, and the United States before going ahead. There's some precedent for a bit of a bumpy road too, as Nvidia's Mellanox deal took a little longer to get through than expected due to pushback from China, so watch this space. Nvidia at least has a year to get all its paperwork in order.

At least one thing is for sure, and that's Arm's continued existence within the UK. Nvidia has stated that it intends to build up Arm's presence in its original location, Cambridge, and that it will use its investment to attract further researchers and engineers to the site. It also intends to continue to register Arm's IP within the UK.

For a few, however, Nvidia's promises to keep the business in the UK are not enough to stem the losses from the initial sale of the UK company to the Santa Clara, California-based company. Arm co-founder, Hermann Hauser, has been critical of the deal, as has the opposition UK Labour Party, and science and technology workers' union Prospect.

Hauser went as far as to call the deal a disaster.

“It’s the last European technology company with global relevance and it’s being sold to the Americans,” Hauser said in an interview with Reuters.

The UK government has so far announced ministers had spoken with both Arm and Nvidia in an effort to discover what the deal meant for Arm and its Cambridge headquarters. CEO Huang said talks with the UK government were yet to begin in earnest.

What does Nvidia buying Arm mean for gaming?

The short answer: not much. At least not right now.

Nvidia's CEO outlined Nvidia's plan to dominate the datacentre and shift away from gaming GPUs recently, and the company's acquisition of Arm is far more inclined to deliver that dream than serve another generation in the GeForce product lineup.

However, it's not entirely without some possible new arrivals in the gaming space. Nvidia would be free to integrate greater Arm capabilities alongside its gaming GPUs within SoCs, which could lead to possible improvements to systems bearing a resemblance to the Nintendo Switch.

An Nvidia Shield Switch with an Ampere GPU and a heterogeneous big.LITTLE hybrid Arm architecture? That's a match made in heaven. If perhaps a little bit of wishful thinking on my part.

Arm and GeForce are likely to remain fairly discrete areas of Nvidia's business. Perhaps we'll feel the impact of Arm's purchase in the overall budget Nvidia sees fit to spend on its gaming segment, especially R&D budget as Nvidia appears to be hopeful of tacking its GPUs under license to Arm's big budget clients. But that potential fiscal injection is only likely to happen once the dust settles, the coin purse strings draw close, and Arm starts making good on its investment.

Jacob earned his first byline writing for his own tech blog. From there, he graduated to professionally breaking things as hardware writer at PCGamesN, and would go on to run the team as hardware editor. He joined PC Gamer's top staff as senior hardware editor before becoming managing editor of the hardware team, and you'll now find him reporting on the latest developments in the technology and gaming industries and testing the newest PC components.