Report: GPU shipments are still sliding as AMD and Nvidia deal with a crypto-hangover

Hopefully this means more deals on last-gen cards.

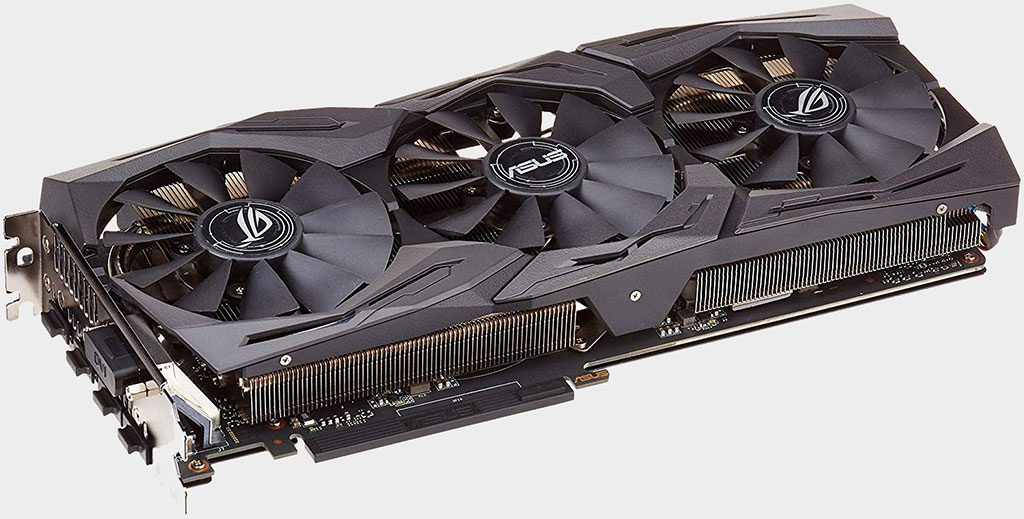

AMD and Nvidia were selling graphics cards at a breakneck pace when the world was infatuated when cryptocurrency mining, but then the bubble burst. Both are still feeling the aftereffects of a post-cryto market—according to a new report by Jon Peddie Research, GPU shipments continued to fall last quarter, and may slide further in the near future.

From a percentage standpoint, Nvidia was hit a little bit harder in the fourth quarter of 2018, with GPU shipments declining 7.6 percent. AMD was not far behind though, at 6.8 percent.

"The channel’s demand for add-in boards (AIBs) in early 2018 was out of sync with what was happening in the market," said Dr. Jon Peddie, president and founder of Jon Peddie Research. "As a result, the channel was burdened with too much inventory. That has impacted sales of discrete GPUs in Q4, and will likely be evident in Q1, and Q2’19 as well."

In other words, retailers are still sitting on excess inventories of graphics cards, by JPR's estimation. We've already seen prices fall following the collapse of the crypto-market at large, but if JPR is correct in its assessment, there could be some tantalizing deals ahead.

Nvidia had obviously hoped that its GeForce RTX series launch would stop the slide, but as the company bluntly noted recently, premium pricing and relatively low adoption of RTX features (real-time ray tracing and Deep Learning Super Sampling) have put a damper on things.

Since the initial launch, however, Nvidia has followed things up with the GeForce RTX 2060, the least expensive RTX card available, and the GeForce GTX 1660 Ti, which is based on the same Turing GPU architecture but without RT or Tensor cores. It's a solid buy in the sub-$300 space, offering performance that is roughly on par with a GeForce GTX 1070 for $279.

The bottom line, though, is that gamers are not marching in droves to buy the latest and greatest from AMD and Nvidia. As we recently noted, adoption of RTX and Vega on Steam is low, at least for the moment. That may change by the end of the year, but from JPR's perspective, things will get worse before they get better.

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

Paul has been playing PC games and raking his knuckles on computer hardware since the Commodore 64. He does not have any tattoos, but thinks it would be cool to get one that reads LOAD"*",8,1. In his off time, he rides motorcycles and wrestles alligators (only one of those is true).